Macy's 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

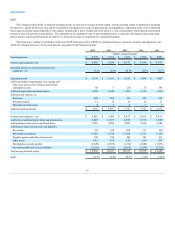

Table of Contents

Important Information Regarding Non-GAAP Financial Measures

The Company reports its financial results in accordance with generally accepted accounting principles ("GAAP"). However, management believes that

certain non-GAAP financial measures provide users of the Company's financial information with additional useful information in evaluating operating

performance. Management believes that providing comparable sales growth including the impact of growth in comparable sales of departments licensed to third

parties supplementally to its results of operations calculated in accordance with GAAP assists in evaluating the Company's ability to generate sales growth,

whether through owned businesses or departments licensed to third parties, on a comparable basis, and in evaluating the impact of changes in the manner in

which certain departments are operated (e.g., the conversion in 2013 of most of the Company's previously owned athletic footwear business to licensed Finish

Line shops). Management believes that excluding certain items that may vary substantially in frequency and magnitude from diluted earnings per share and

from operating income and EBITDA as percentages to sales are useful supplemental measures that assist in evaluating the Company's ability to generate

earnings and leverage sales, respectively, and to more readily compare these metrics between past and future periods. Management also believes that EBITDA

and Adjusted EBITDA are frequently used by investors and securities analysts in their evaluations of companies, and that such supplemental measures

facilitate comparisons between companies that have different capital and financing structures and/or tax rates. In addition, management believes that ROIC is a

useful supplemental measure in evaluating how efficiently the Company employs its capital. The Company uses some of these non-GAAP financial measures

as performance measures for components of executive compensation.

Non-GAAP financial measures should be viewed as supplementing, and not as an alternative or substitute for, the Company's financial results prepared

in accordance with GAAP. Certain of the items that may be excluded or included in non-GAAP financial measures may be significant items that could impact

the Company's financial position, results of operations and cash flows and should therefore be considered in assessing the Company's actual financial

condition and performance. Additionally, the amounts received by the Company on account of sales licensed to third parties are limited to commissions

received on such sales. The methods used by the Company to calculate its non-GAAP financial measures may differ significantly from methods used by other

companies to compute similar measures. As a result, any non-GAAP financial measures presented herein may not be comparable to similar measures provided

by other companies.

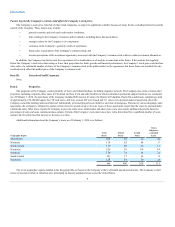

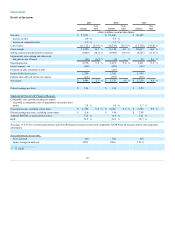

Comparable Sales Growth Including the Impact of Growth in Comparable Sales of Departments Licensed to Third Parties

The following is a tabular reconciliation of the non-GAAP financial measure comparable sales growth including the impact of growth in comparable

sales of departments licensed to third parties, to GAAP comparable sales, which the Company believes to be the most directly comparable GAAP financial

measure.

Increase in comparable sales (note 1)

1.9%

3.7%

5.3%

4.6%

Impact of growth in comparable sales of departments licensed

to third parties (note 2)

0.9%

0.3%

0.4%

(0.2)%

Comparable sales growth including the impact of growth in comparable sales of

departments licensed to third parties

2.8%

4.0%

5.7%

4.4%

Notes:

(1) Represents the period-to-period percentage change in net sales from stores in operation throughout the year presented and the immediately preceding year

and all net Internet sales, adjusting for the 53rd week in 2012, excluding commissions from departments licensed to third parties. Stores undergoing

remodeling, expansion or relocation remain in the comparable sales calculation unless the store is closed for a significant period of time. Definitions and

calculations of comparable sales differ among companies in the retail industry.

(2) Represents the impact on comparable sales of including the sales of departments licensed to third parties occurring in stores in operation throughout the

year presented and the immediately preceding year and via the Internet in the calculation. The Company licenses third parties to operate certain

departments in its stores and online and receives commissions from these third parties based on a percentage of their net sales. In its financial statements

prepared in conformity with GAAP, the Company includes these commissions (rather than sales of the departments licensed to third parties) in its net

sales. The Company does not, however, include any amounts in respect of licensed department sales in its comparable sales in accordance with GAAP.

16