Macy's 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

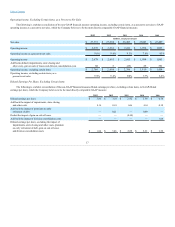

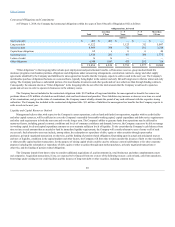

Comparison of 2013 and 2012

Net Income

Net income for 2013 increased compared to 2012, reflecting the benefits of the key strategies at Macy's, the continued strong performance at

Bloomingdale's and good expense management, including higher income from credit operations, lower depreciation and amortization expense, and gains on the

sale of certain office buildings and surplus properties, partially offset by greater investments in the Company's omnichannel operations.

Net Sales

Net sales for 2013, which had one fewer week than 2012, increased $245 million or 0.9% compared to 2012. On a comparable basis, net sales for 2013

were up 1.9% compared to 2012. Together with sales of departments licensed to third parties, 2013 sales on a comparable basis were up 2.8%. (See page 16

for information regarding the Company's calculation of comparable sales, a reconciliation of the non-GAAP measure which takes into account sales of

departments licensed to third parties to the most comparable GAAP measure and other important information). The Company continues to benefit from the

successful execution of the My Macy's localization, Omnichannel and Magic Selling strategies. Geographically, sales in 2013 were strongest in the southern

regions. By family of business, sales in 2013 were strongest in active apparel, handbags, textiles, luggage, furniture and mattresses. Sales in 2013 were less

strong in juniors. Sales of the Company's private label brands continued to be strong and represented approximately 20% of net sales in the Macy's-branded

stores in 2013.

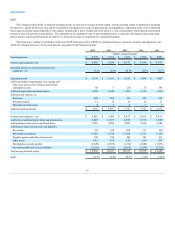

Cost of Sales

Cost of sales for 2013 increased $187 million from 2012. The cost of sales rate as a percent to net sales of 59.9% was 20 basis points higher in 2013,

as compared to 59.7% in 2012, primarily due to continued growth of the omnichannel businesses and the resulting impact of free shipping. The application

of the last-in, first-out (LIFO) retail inventory method did not result in the recognition of any LIFO charges or credits affecting cost of sales in either period.

Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses for 2013 decreased $42 million from 2012. The SG&A rate as a percent to net sales of 30.2%

was 50 basis points lower in 2013, as compared to 2012, reflecting the decrease in SG&A expenses and increased net sales. SG&A expenses in 2013 benefited

from higher income from credit operations, lower depreciation and amortization expense, and gains on the sale of certain office buildings and surplus

properties, partially offset by greater investments in the Company's omnichannel operations. Income from credit operations was $731 million in 2013 as

compared to $663 million in 2012. Depreciation and amortization expense was $1,020 million for 2013, compared to $1,049 million for 2012. 2013 included

gains on the sales of office buildings and surplus properties of $79 million. Advertising expense, net of cooperative advertising allowances, was $1,166

million for 2013 compared to $1,123 million for 2012. Advertising expense, net of cooperative advertising allowances, as a percent to net sales was 4.2% for

2013 compared to 4.1% for 2012.

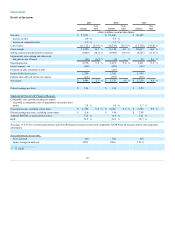

Impairments, Store Closing and Other Costs and Gain on Sale of Leases

Impairments, store closing and other costs and gain on sale of leases for 2013 includes costs and expenses primarily associated with cost-reduction

initiatives and store closings announced in January 2014. During 2013, these costs and expenses included $43 million of severance and other human resource-

related costs, asset impairment charges of $39 million and $6 million of other related costs and expenses. Impairments, store closing and other costs and gain

on sale of leases for 2012 included $4 million of asset impairment charges primarily related to the store closings announced in January 2013.

Net Interest Expense

Net interest expense for 2013 decreased $34 million from 2012. Net interest expense for 2013 benefited from lower rates on outstanding borrowings as

compared to 2012.

21