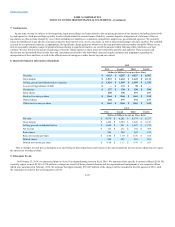

Kohl's 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the Company. The amount of such Severance Benefit shall be reduced by any compensation (including any payments from the Company or any benefit

plans, policies or programs sponsored by the Company) earned or received by Executive during the six (6) month period following the date of termination

and the six (6) month period during which Executive receives the Severance Benefit, and Executive agrees to reimburse the Company for the amount of any

such reduction. Executive acknowledges and agrees that, upon the cessation, if any, of such Disability during the period of the payment of the Severance

Benefit, he/she has an obligation to use his/her reasonable efforts to secure other employment consistent with Executive’s status and experience and that

his/her failure to do so, as determined at the sole discretion of the Board, is a breach of this Agreement. Furthermore, under this Section 3.2(c), vesting of any

Company stock options granted to Executive shall cease on the effective date of termination, and any unvested stock options shall lapse and be forfeited as

of such date.

(d) Termination By Company Without Cause or By Executive for Good Reason.

i. No Change of Control. If Executive’s employment is terminated by the Company pursuant to Section 3.1(a), above, or by

Executive pursuant to Section 3.1(c), above, and such termination does not occur three (3) months prior to or within one (1) year after the occurrence

of a Change of Control (defined below), Executive shall have no further rights against the Company hereunder, except for the right to receive

(A) Accrued Benefits; (B) a Severance Payment (defined below); (C) the Pro Rata Bonus (defined below); provided, however, that the Pro Rata

Bonus payment shall be made at the same time as any such bonuses are paid to other similarly situated executives of the Company; (D)

outplacement services from an outplacement service company of the Company’s choosing at a cost not to exceed Twenty Thousand Dollars

($20,000.00), payable directly to such outplacement service company (“Outplacement Services”); and (E) Health Insurance Continuation (defined

below).

For purposes of this Section 3.2(d)(i), “Severance Payment” means an amount equal to the sum of:

(x) Executive’s Base Salary for the remainder of the then current Initial Term or Renewal Term of this Agreement, but not to exceed two and

nine-tenths (2.9) years; plus

(y) an amount equal to the average (calculated at the sole discretion of the Company) of bonuses paid or payable, including any amounts

that were deferred, in respect of the three (3) fiscal years immediately preceding the fiscal year in which the effective date of termination

occurs.

The Severance Payment shall be paid to Executive in a lump sum within forty (40) days after the effective date of termination, subject to Section

3.2(e) below.

For purposes of this Section 3.2(d)(i), the “Pro Rata Bonus” means an amount equal to the product of:

(x) the bonus attributable to the fiscal year of the Company during which the Executive’s termination occurs equal in amount to the bonus

the Executive would have received for the full fiscal year had the Executive’s employment not terminated and determined, where

applicable, by taking into account the actual performance of the Company at year-end; and

(y) a fraction, the numerator of which is the number of days completed in the fiscal year in which the effective date of termination occurs

through the effective date of termination and the denominator of which is three hundred sixty-five (365).

Furthermore, under this Section 3.2(d)(i), vesting of any Company stock options granted to Executive prior to the date of termination shall continue

as scheduled until the term of this Agreement expires, after which such vesting ceases and any unvested stock options lapse and are forfeited.

ii. Change of Control. If Executive’s employment is terminated by the Company pursuant to Section 3.1(a), above, or by the

Executive pursuant to Section 3.1(c), above, and such termination occurs within three (3) months prior to or one (1) year after the occurrence of a

Change of Control (defined below), Executive shall have no further rights against the Company hereunder, except for the right to receive (A)

Accrued Benefits; (B) a Severance Payment (defined below); (C) the Historic Pro Rata Bonus; provided, however, that such bonus payments shall be

made at the same time as any such bonuses are paid to other similarly situated executives of the Company; (D) Health Insurance Continuation

(defined below) for the period of time equal to the remainder of the then-current Renewal Term, but not to exceed two and nine-tenths (2.9) years

following the effective date of Executive’s termination; and (E) Outplacement Services.