Kohl's 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

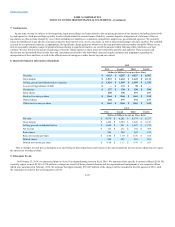

At any time, we may be subject to investigations, legal proceedings, or claims related to the on-going operation of our business, including claims both

by and against us. Such proceedings typically involve claims related to various forms of liability, contract disputes, allegations of violations of laws or

regulations or other actions brought by us or others including our employees, consumers, competitors, suppliers or governmental agencies. We routinely

assess the likelihood of any adverse outcomes related to these matters on a case by case basis, as well as the potential ranges of losses and fees. We establish

accruals for our potential exposure, as appropriate, for significant claims against us when losses become probable and reasonably estimable. Where we are

able to reasonably estimate a range of potential losses relating to significant matters, we record the amount within that range that constitutes our best

estimate. We also disclose the nature of and range of loss for claims against us when losses are reasonably possible and material. These accruals and

disclosures are determined based on the facts and circumstances related to the individual cases and require estimates and judgments regarding the

interpretation of facts and laws, as well as the effectiveness of strategies or other factors beyond our control.

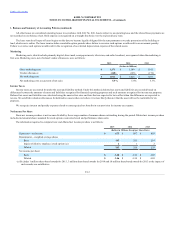

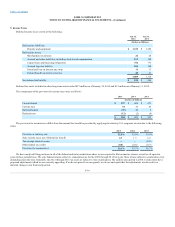

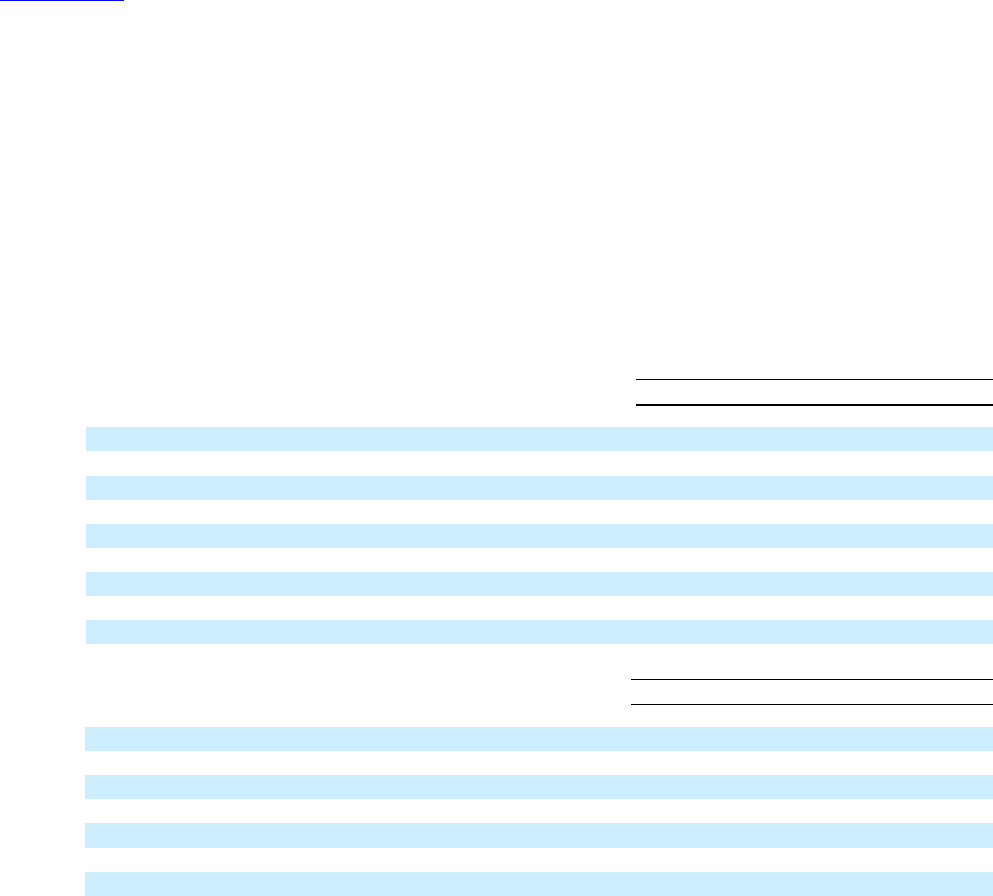

Net sales

Gross margin

Selling, general and administrative expenses

Loss on extinguishment of debt

Net income

Basic shares

Basic net income per share

Diluted shares

Diluted net income per share

Net sales $ 4,070

$ 4,242

$ 4,374

$ 6,337

Gross margin $ 1,496

$ 1,654

$ 1,628

$ 2,147

Selling, general and administrative $ 1,000

$ 981

$ 1,097

$ 1,272

Net income $ 125

$ 232

$ 142

$ 369

Basic shares 206

204

202

199

Basic net income per share $ 0.60

$ 1.14

$ 0.70

$ 1.85

Diluted shares 208

205

203

201

Diluted net income per share $ 0.60

$ 1.13

$ 0.70

$ 1.83

Due to changes in stock prices during the year and timing of share repurchases and issuances, the sum of quarterly net income per share may not equal

the annual net income per share.

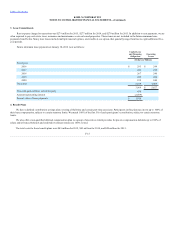

On February 25, 2016, we announced plans to close 18 underperforming stores in fiscal 2016. We announced the specific locations in March 2016. We

currently expect to incur $150 to $170 million in charges as a result of these planned closures and the organizational realignment at our corporate offices

which were announced in February 2016. We estimate that approximately $55-$65 million of the charges will be recorded in the first quarter of 2016, with

the remainder recorded in the second quarter of 2016.

F-20