Kohl's 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

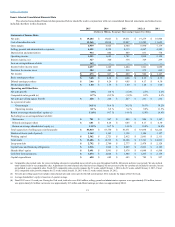

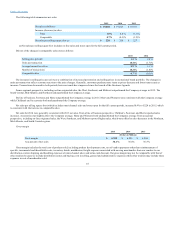

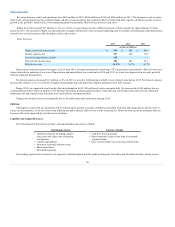

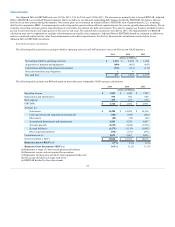

Key financial ratios

The following ratios provide additional measures of our liquidity, return on investments, and capital structure.

Working capital

$2,721

$2,412

Current ratio

1.95

1.87

Free cash flow (a)

$1,234

$1,127

Ratio of earnings to fixed charges

3.6

3.7

Return on assets

6.1%

6.3%

Return on gross investment (a)

15.2%

15.5%

Debt/capitalization

44.3%

44.8%

Adjusted Debt to EBITDAR (a)

2.45

2.42

(a) Non-GAAP financial measure

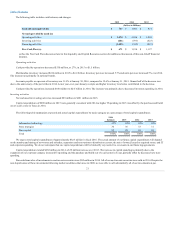

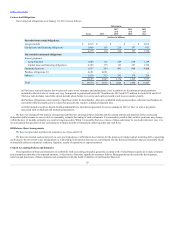

Liquidity ratios

Liquidity measures our ability to meet short-term cash needs. In 2015, working capital decreased $359 million and our current ratio decreased 8 basis

points from year-end 2014 due to a decrease in cash, which was partially offset by an increase in inventory and decrease in accounts payable. In 2014,

working capital increased $309 million and our current ratio increased 8 basis points over year-end 2013 due to an increase in cash, which was partially offset

by a decrease in inventory and increase in accounts payable.

We generated $671 million of free cash flow for 2015; a decrease of $563 million from 2014. As discussed above, the decrease is primarily the result of

a decrease in cash provided by operating activities in 2015. Free cash flow is a non-GAAP financial measure which we define as net cash provided by

operating activities and proceeds from financing obligations (which generally represent landlord reimbursements of construction costs) less capital

expenditures and capital lease and financing obligation payments. Free cash flow should be evaluated in addition to, and not considered a substitute for,

other financial measures such as net income and cash flow provided by operations. We believe that free cash flow represents our ability to generate additional

cash flow from our business operations. See the key financial ratio calculations section above.

Return on investment ratios

Lower earnings, including the loss on extinguishment of debt, caused decreases in all three of our return on investment ratios - ratio of earnings to fixed

charges, return on assets and return on gross investment ("ROI"). See Exhibit 12.1 to this Annual Report on Form 10-K for the calculation of our ratio of

earnings to fixed charges and the key financial ratio calculations below for the return on assets and ROI calculations.

We believe that ROI is a useful financial measure in evaluating our operating performance. When analyzed in conjunction with our net earnings and

total assets and compared with return on assets, it provides investors with a useful tool to evaluate our ongoing operations and our management of assets from

period to period. ROI is a non-GAAP financial measure which we define as earnings before interest, taxes, depreciation, amortization and rent (“EBITDAR”)

divided by average gross investment. Our ROI calculation may not be comparable to similarly-titled measures reported by other companies. ROI should be

evaluated in addition to, and not considered a substitute for, other financial measures such as return on assets.

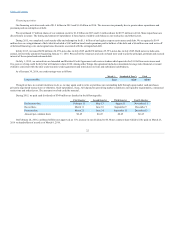

Capital structure ratios

Our debt agreements contain various covenants including limitations on additional indebtedness and a maximum permitted debt ratio. As of January

30, 2016, we were in compliance with all debt covenants and expect to remain in compliance during 2016. See the key financial ratio calculations section

below for our debt covenant calculation.

Our debt/capitalization ratio was 46.3% at year-end 2015 and 44.3% at year-end 2014. The increase is primarily due to treasury stock purchases in

2015.

23