Kohl's 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

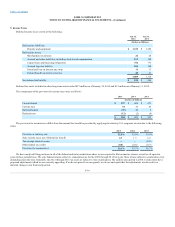

All other leases are considered operating leases in accordance with ASC No. 840. Assets subject to an operating lease and the related lease payments are

not recorded on our balance sheet. Rent expense is recognized on a straight-line basis over the expected lease term.

The lease term for all types of leases begins on the date we become legally obligated for the rent payments or we take possession of the building or

land, whichever is earlier. The lease term includes cancelable option periods where failure to exercise such options would result in an economic penalty.

Failure to exercise such options would result in the recognition of accelerated depreciation expense of the related assets.

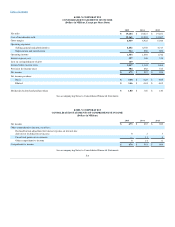

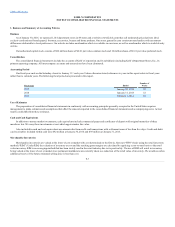

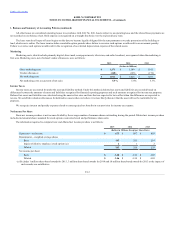

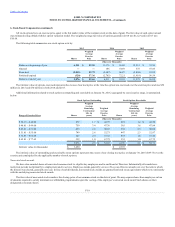

Marketing costs, which include primarily digital, direct mail, newspaper inserts, television, and radio broadcast, are expensed when the marketing is

first seen. Marketing costs, net of related vendor allowances, were as follows:

Gross marketing costs

$ 1,189

$ 1,185

Vendor allowances

(165)

(172)

Net marketing costs

$ 1,024

$ 1,013

Net marketing costs as a percent of net sales

5.4%

5.3%

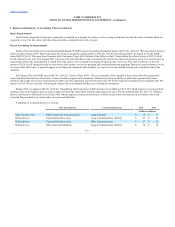

Income taxes are accounted for under the asset and liability method. Under this method, deferred tax assets and liabilities are recorded based on

differences between the amounts of assets and liabilities recognized for financial reporting purposes and such amounts recognized for income tax purposes.

Deferred tax assets and liabilities are calculated using the enacted tax rates and laws that are expected to be in effect when the differences are expected to

reverse. We establish valuation allowances for deferred tax assets when we believe it is more likely than not that the asset will not be realizable for tax

purposes.

We recognize interest and penalty expense related to unrecognized tax benefits in our provision for income tax expense.

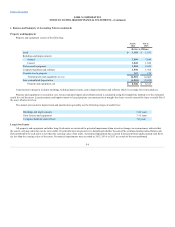

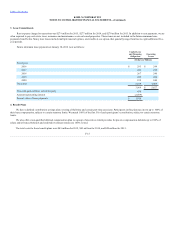

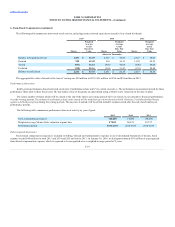

Basic net income per share is net income divided by the average number of common shares outstanding during the period. Diluted net income per share

includes incremental shares assumed for stock options, nonvested stock and performance share units.

The information required to compute basic and diluted net income per share is as follows:

Numerator—net income

$ 867

$ 889

Denominator—weighted average shares

Basic

203

218

Impact of dilutive employee stock options (a)

1

2

Diluted

204

220

Net income per share:

Basic

$ 4.28

$ 4.08

Diluted

$ 4.24

$ 4.05

(a) Excludes 1 million share-based awards for 2015, 3 million share-based awards for 2014 and 10 million share-based awards for 2013 as the impact of

such awards was antidilutive.

F-12