Kohl's 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

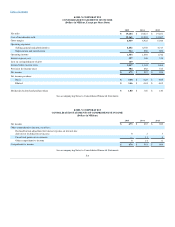

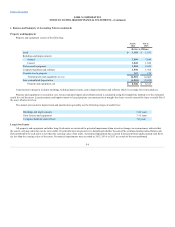

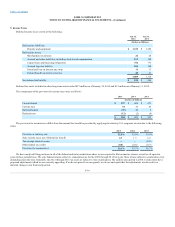

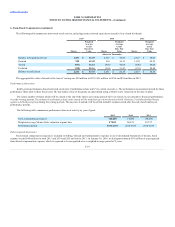

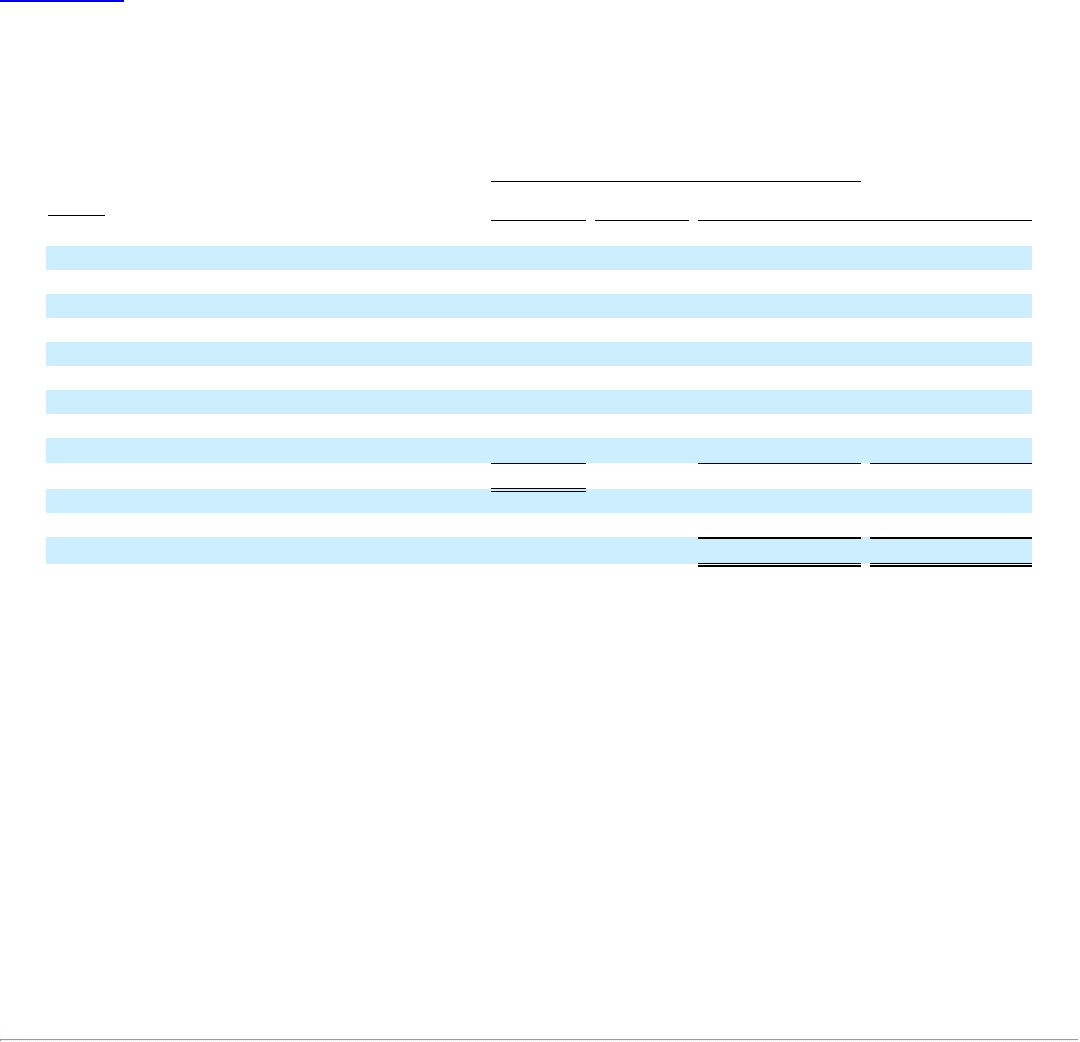

Long-term debt consists of the following unsecured senior debt:

2021 4.81%

4.00%

$ 650

2023 3.25%

3.25%

350

2023 4.78%

4.75%

300

2025 4.25%

4.25%

—

2029 7.36%

7.25%

200

2033 6.05%

6.00%

300

2037 6.89%

6.88%

350

2045 5.57%

5.55%

—

2017 n/a

n/a

650

4.88%

2,800

Unamortized debt discount

(7)

Deferred financing costs

(13)

Long-term debt

$ 2,780

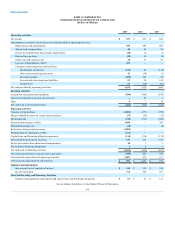

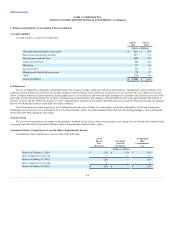

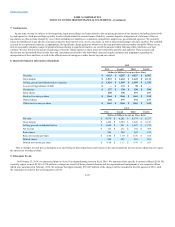

Based on quoted market prices (Level 1 per ASC No. 820, "Fair Value Measurements and Disclosures"), the estimated fair value of our long-term debt

was $2.8 billion at January 30, 2016 and $3.1 billion at January 31, 2015.

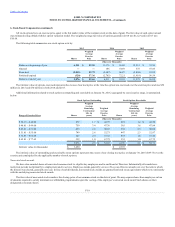

During 2015, we completed a cash tender offer and redemption for $1,085 million of senior unsecured debt. We recognized a $169 million loss on

extinguishment of debt which included a $163 million bond tender premium paid to holders of the debt and a $6 million non-cash write-off of deferred

financing costs and original issue discounts associated with the extinguished debt.

In July 2015, we issued $650 million of 4.25% notes due in July 2025 and $450 million of 5.55% notes due in July 2045. Both notes include semi-

annual, interest-only payments which began January 17, 2016. Proceeds of the issuances and cash on hand were used to pay the principal, premium and

accrued interest of the debt which was settled in July and August 2015.

In July 2015, we entered into an Amended and Restated Credit Agreement with various lenders which provides for a $1.0 billion senior unsecured five-

year revolving credit facility that will mature in June 2020. Among other things, the agreement includes a maximum leverage ratio financial covenant (which

is consistent with the ratio under our prior credit agreement) and restrictions on liens and subsidiary indebtedness. As of January 30, 2016 and January 31,

2015, there were no outstanding balances on the revolving credit facility. We borrowed $400 million during the third quarter of 2015 with an effective

interest rate of 1.27% and repaid the entire balance in the fourth quarter.

Our various debt agreements contain covenants including limitations on additional indebtedness and certain financial tests. As of January 30, 2016, we

were in compliance with all covenants of the various debt agreements.

We also have outstanding trade letters of credit and stand-by letters of credit totaling approximately $35 million at January 30, 2016, issued under

uncommitted lines with two banks.

F-14