Kohl's 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

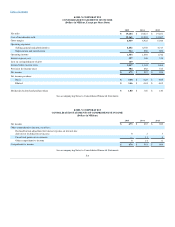

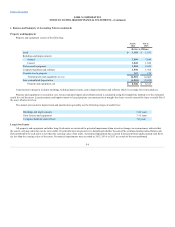

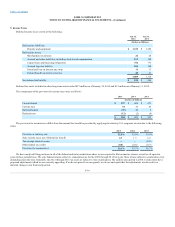

Property and equipment consist of the following:

Land

$ 1,103

Buildings and improvements:

Owned

7,844

Leased

1,848

Fixtures and equipment

2,032

Computer hardware and software

1,368

Construction in progress

210

Total property and equipment, at cost

14,405

Less accumulated depreciation

(5,890)

Property and equipment, net

$ 8,515

Construction in progress includes buildings, building improvements, and computer hardware and software which is not ready for its intended use.

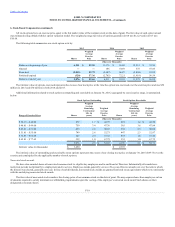

Property and equipment is recorded at cost, less accumulated depreciation. Depreciation is calculated using the straight-line method over the estimated

useful lives of the assets. Leased property and improvements to leased property are amortized on a straight-line basis over the term of the lease or useful life of

the asset, whichever is less.

The annual provisions for depreciation and amortization generally use the following ranges of useful lives:

Buildings and improvements 5-40 years

Store fixtures and equipment 3-15 years

Computer hardware and software 3-8 years

All property and equipment and other long-lived assets are reviewed for potential impairment when events or changes in circumstances indicate that

the asset’s carrying value may not be recoverable. If such indicators are present, it is determined whether the sum of the estimated undiscounted future cash

flows attributable to such assets is less than the carrying value of the assets. A potential impairment has occurred if projected future undiscounted cash flows

are less than the carrying value of the assets. No material impairments were recorded in 2015, 2014, or 2013 as a result of the tests performed.

F-8