Kohl's 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

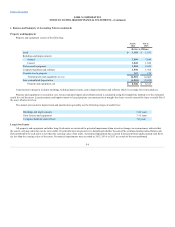

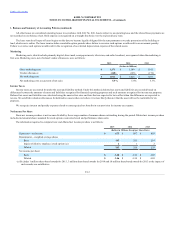

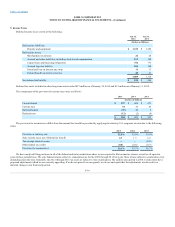

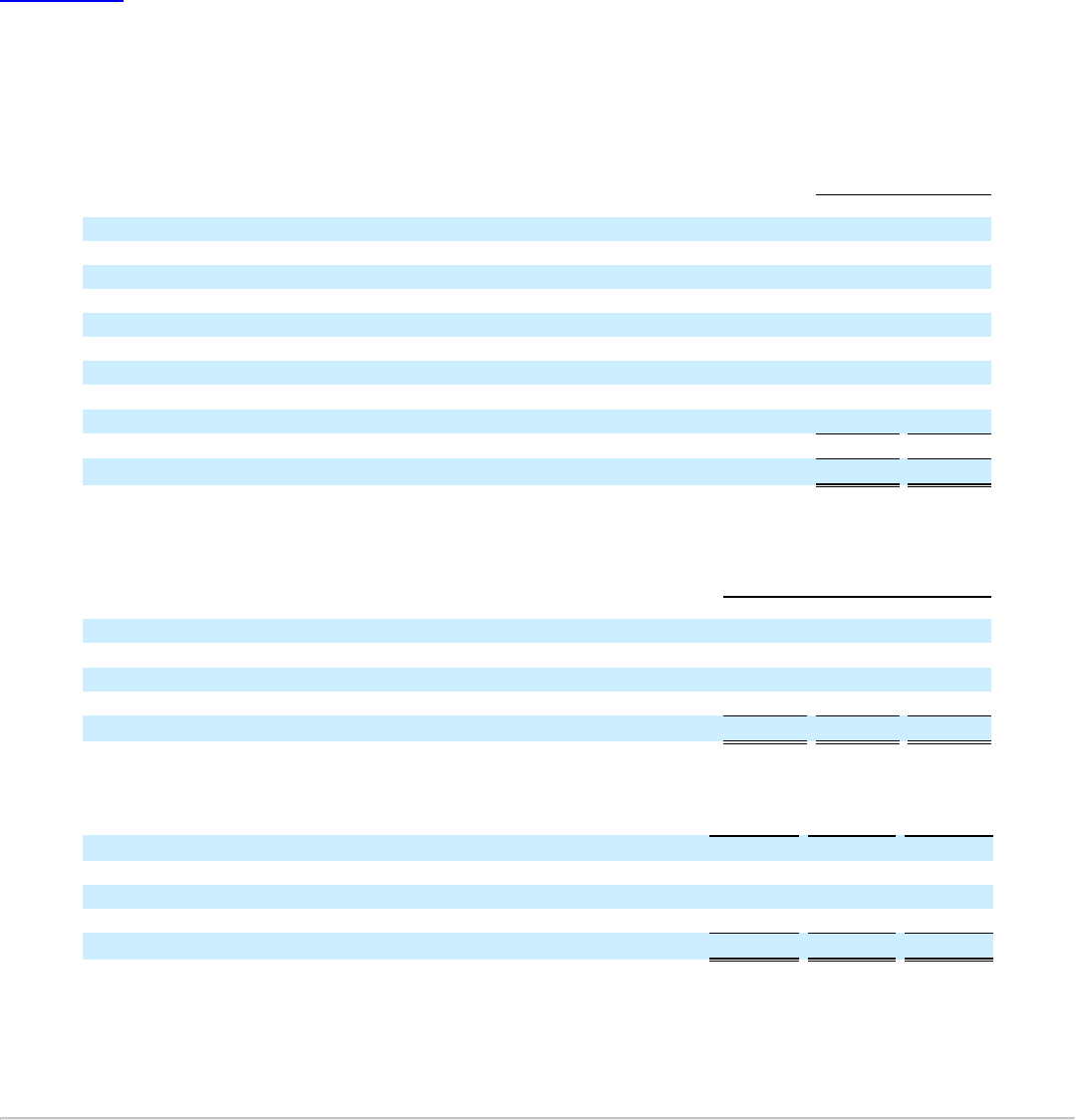

Deferred income taxes consist of the following:

Deferred tax liabilities:

Property and equipment

$ 1,385

Deferred tax assets:

Merchandise inventories

24

Accrued and other liabilities, including stock-based compensation

168

Capital lease and financing obligations

773

Accrued step rent liability

100

Unrealized loss on interest rate swap

13

Federal benefit on state tax reserves

41

1,119

Net deferred tax liability

$ 266

Deferred tax assets included in other long-term assets totaled $27 million as of January 30, 2016 and $32 million as of January 31, 2015.

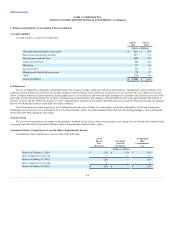

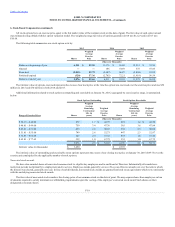

The components of the provision for income taxes were as follows:

Current federal

$ 400

$ 473

Current state

36

45

Deferred federal

48

6

Deferred state

(2)

(9)

$ 482

$ 515

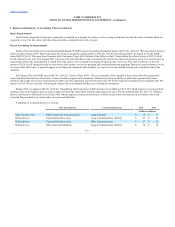

The provision for income taxes differs from the amount that would be provided by applying the statutory U.S. corporate tax rate due to the following

items:

Provision at statutory rate

35.0%

35.0%

State income taxes, net of federal tax benefit

1.3

2.2

Tax-exempt interest income

—

(0.2)

Other federal tax credits

(0.6)

(0.3)

Provision for income taxes

35.7%

36.7%

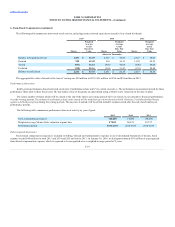

We have analyzed filing positions in all of the federal and state jurisdictions where we are required to file income tax returns, as well as all open tax

years in these jurisdictions. The only federal returns subject to examination are for the 2009 through 2015 tax years. State returns subject to examination vary

depending upon the state. Generally, the 2012 through 2015 tax years are subject to state examination. The earliest open period is 2004. Certain states have

proposed adjustments which we are currently appealing. If we do not prevail on our appeals, we do not anticipate that the adjustments would result in a

material change in our financial position.

F-16