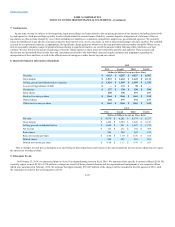

Kohl's 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months,

or (ii) has been, by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last

for a continuous period of not less than twelve (12) months, receiving income replacement benefits for a period of not less than three (3) months under an

accident and health plan covering employees of the Company. A determination of Disability shall be made by the Company, which may, at its sole

discretion, consult with a physician or physicians satisfactory to the Company, and Executive shall cooperate with any efforts to make such determination.

Any such determina-tion shall be conclusive and binding on the parties. Any determination of Disability under this Section 3.1(d) is not intended to alter

any benefits any party may be entitled to receive under any disability insurance policy carried by either the Company or Executive with respect to Executive,

which benefits shall be governed solely by the terms of any such insurance policy.

(e) Termination by Resignation. Subject to Section 3.2, below, Executive’s employment and the Company’s obligations under this

Agreement shall terminate automatically, effective immediately upon Executive’s provision of written notice to the Company of Executive’s resignation

from employment with the Company or at such other time as may be mutually agreed between the Parties following the provision of such notice.

(f) Separation of Service. A termination of employment under this Agreement shall only occur to the extent Executive has a “separation

from service” from Company in accordance with Section 409A of the Code. Under Section 409A, a “separation from service” occurs when Executive and the

Company reasonably anticipate that no further services will be performed by Executive after a certain date or that the level of bona fide services Executive

would perform after such date (whether as an employee or as a consultant) would permanently decrease to no more than 20 percent of the average level of

bona fide services performed by Executive over the immediately preceding 36-month period.

3.2 Rights Upon Termination.

(a) Termination By Company for Cause, By Company’s Non-Renewal or By Executive Due to Resignation Other Than For Good Reason .

If Executive’s employment is terminated by the Company pursuant to Section 3.1(b), above, by the Company due to non-renewal pursuant to Section 1.1,

above, or by Executive pursuant to Section 3.1(e), above, Executive shall have no further rights against the Company hereunder, except for the right to

receive (i) any unpaid Base Salary with respect to the period prior to the effective date of termination together with payment of any vacation that Executive

has accrued but not used through the date of termination; (ii) reimbursement of expenses to which Executive is entitled under Section 2.2, above; and (iii)

Executive’s unpaid bonus, if any, attributable to any complete fiscal year of the Company ended before the date of termination (in the aggregate, the

“Accrued Benefits”). Any such bonus payment shall be made at the same time as any such bonus is paid to other similarly situated executives of the

Company. Furthermore, under this Section 3.2(a), vesting of any Company stock options granted to Executive ceases on the effective date of termination,

and any unvested stock options lapse and are forfeited immediately upon the effective date of termination.

(b) Termination Due to Executive’s Death. If Executive’s employment is terminated due to Executive’s death pursuant to Section 3.1(d),

above, Executive shall have no further rights against the Company hereunder, except for the right to receive (i) Accrued Benefits; (ii) Health Insurance

Continuation (defined below); and (iii) a share of any bonus attributable to the fiscal year of the Company during which the effective date of termination

occurs determined as follows: the product of (x) the average bonuses paid or payable, including any amounts that were deferred in respect of the three (3)

fiscal years immediately preceding the fiscal year in which the effective date of termination occurs and (y) a fraction, the numerator of which is the number of

days completed in the fiscal year in which the effective date of termination occurs through the effective date of termination and the denominator of which is

three hundred sixty-five (365) (the “Historic Pro Rata Bonus”). The Pro Rata Bonus or the Historic Pro Rata Bonus shall be paid at the same time as any such

bonuses are paid to other similarly situated executives of the Company. Upon termination due to the Executive’s death, Executive shall also be entitled to a

severance payment equal to fifty percent (50%) of Executive’s Base Salary payable for one (1) year following the effective date of termination pursuant to

normal payroll practices. Furthermore, under this Section 3.2(b), if Executive’s termination is due to Executive’s death, all Company stock options granted

to Executive shall immediately vest upon the date of Executive’s death.

(c) Termination Due to Disability. If Executive’s employment is terminated due to Executive’s Disability pursuant to Section 3.1(d),

above, Executive shall have no further rights against the Company hereunder, except for the right to receive (i) Accrued Benefits; (ii) Health Insurance

Continuation (defined below); (iii) the Historic Pro Rata Bonus; and (iv) a Severance Benefit. The Historic Pro Rata Bonus payment shall be made at the

same time as any such bonuses are paid to other similarly situated executives of the Company. For purposes of this Section 3.2(c), “Severance Benefit”

means six (6) months of Base Salary, payable in equal installments during the six (6) month period following Executive’s exhaustion of any short-term

disability benefits provided by the Company, in accordance with the normal payroll practices and schedule of