Kohl's 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

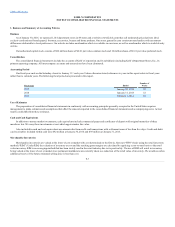

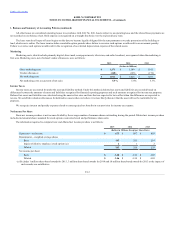

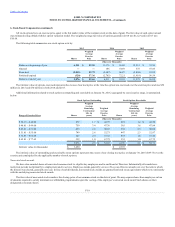

A reconciliation of the beginning and ending gross amount of unrecognized tax benefits is as follows:

Balance at beginning of year

$ 125

Increases due to:

Tax positions taken in prior years

—

Tax positions taken in current year

21

Decreases due to:

Tax positions taken in prior years

(16)

Settlements with taxing authorities

(2)

Lapse of applicable statute of limitations

(5)

Balance at end of year

$ 123

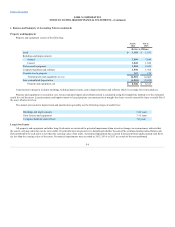

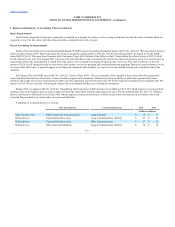

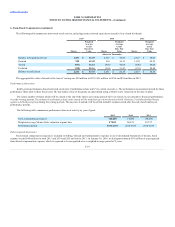

Not included in the unrecognized tax benefits reconciliation above are gross unrecognized accrued interest and penalties of $23 million at both

January 30, 2016 and January 31, 2015. We had no interest and penalty expense for 2015, $2 million for 2014, and $3 million for 2013.

Our total unrecognized tax benefits that, if recognized, would affect our effective tax rate were $101 million as of January 30, 2016 and $89 million as

of January 31, 2015. It is reasonably possible that our unrecognized tax positions may change within the next 12 months, primarily as a result of ongoing

audits. While it is possible that one or more of these examinations may be resolved in the next year, it is not anticipated that a significant impact to the

unrecognized tax benefit balance will occur.

We have both payables and receivables for current income taxes recorded on our balance sheet. Receivables included in other current assets totaled $26

million as of January 30, 2016 and $25 million as of January 31, 2015.

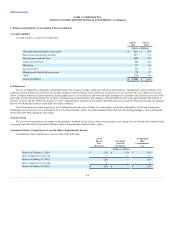

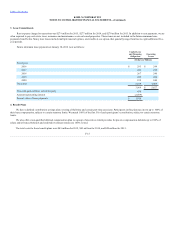

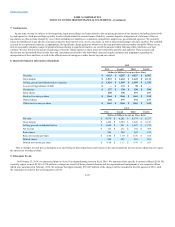

We currently grant share-based compensation pursuant to the Kohl’s Corporation 2010 Long-Term Compensation Plan, which provides for the granting

of various forms of equity-based awards, including nonvested stock, performance share units and options to purchase shares of our common stock, to officers,

key employees and directors. As of January 30, 2016, there were 18.5 million shares authorized and 11.2 million shares available for grant under the 2010

Long-Term Compensation Plan. Options and nonvested stock that are surrendered or terminated without issuance of shares are available for future grants.

Annual grants are typically made in the first quarter of the fiscal year. Grants to newly-hired and promoted employees and other discretionary grants are

made periodically throughout the remainder of the year. We also have outstanding options which were granted under previous compensation plans.

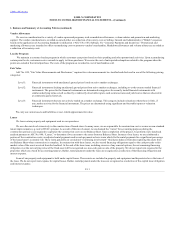

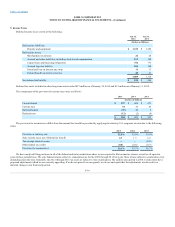

Stock options

The majority of stock options granted to employees typically vest in five equal annual installments. Outstanding options granted to employees after

2005 have a term of seven years. Outstanding options granted to employees prior to 2006 have a term of up to 15 years. Outstanding options granted to

directors have a term of 10 years.

F-17