Kohl's 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

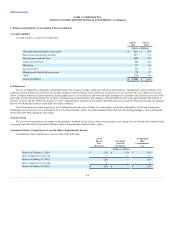

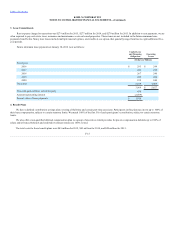

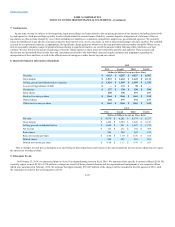

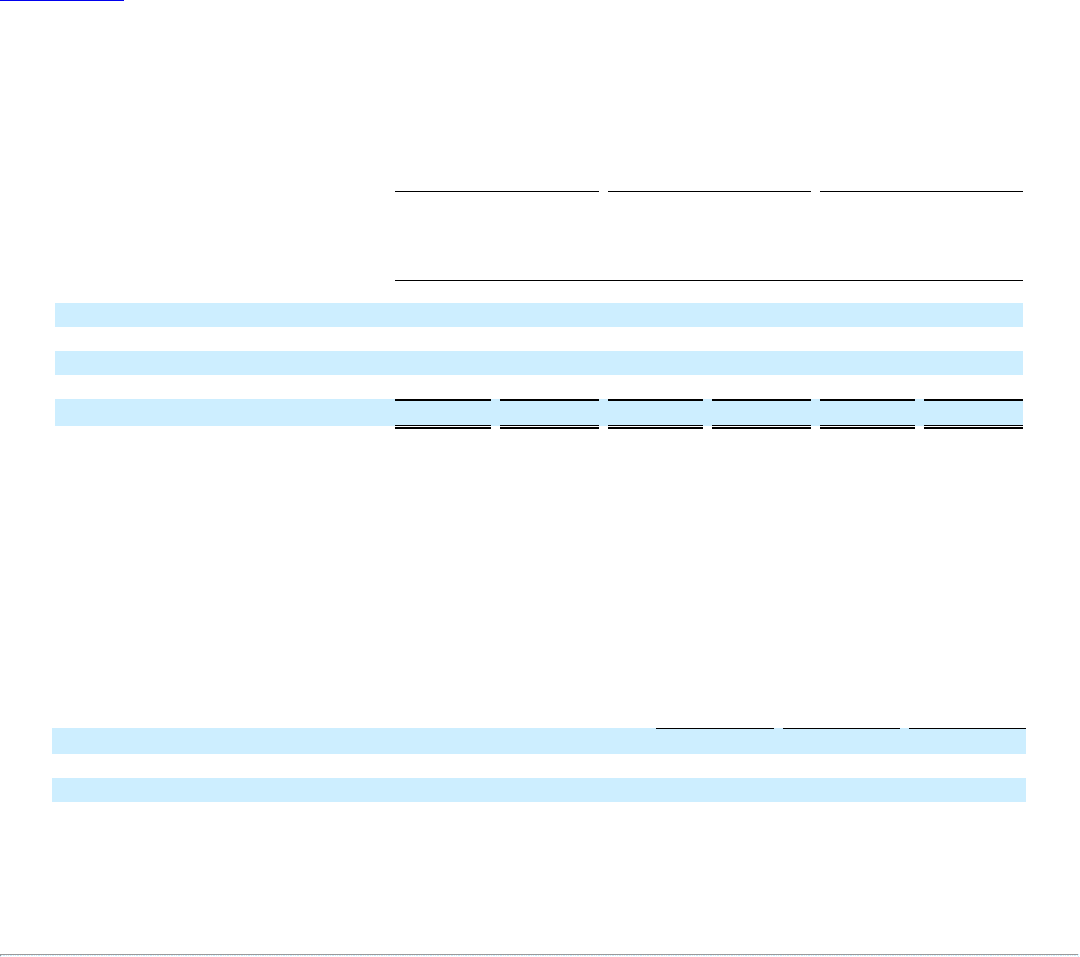

The following table summarizes nonvested stock activity, including restricted stock equivalents issued in lieu of cash dividends:

Balance at beginning of year

2,653

$ 50.56

2,323

$ 50.47

Granted

910

56.13

1,189

49.22

Vested

(818)

50.69

(706)

48.00

Forfeited

(314)

51.47

(153)

50.48

Balance at end of year

2,431

$ 52.29

2,653

$ 50.56

The aggregate fair value of awards at the time of vesting was $50 million in 2015, $41 million in 2014 and $34 million in 2013.

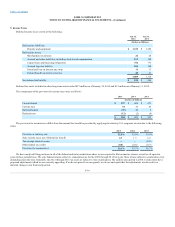

Performance share units

Kohl's grants performance-based restricted stock units ("performance share units") to certain executives. The performance measurement period for these

performance share units is three fiscal years. The fair market value of the grants are determined using a Monte-Carlo valuation on the date of grant.

The actual number of shares which will be earned at the end of the three-year vesting periods will vary based on our cumulative financial performance

over the vesting periods. The number of performance share units earned will be modified up or down based on Kohl’s Relative Total Shareholder Return

against a defined peer group during the vesting periods. The payouts, if earned, will be settled in Kohl's common stock after the end of each multi-year

performance periods.

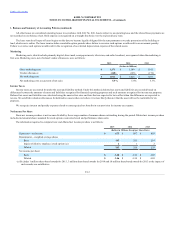

The following table summarizes performance share unit activity by year of grant:

Units outstanding (at Target)

14,000

170,000

Weighted average Monte-Carlo valuation at grant date

$62.39

$57.37

Performance period

2014-2016

2014-2016

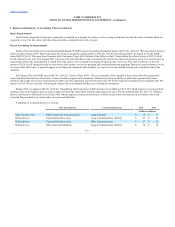

Other required disclosures

Stock-based compensation expense is included in Selling, General and Administrative expense in our Consolidated Statements of Income. Such

expense totaled $48 million for both 2015 and 2014 and $55 million for 2013. At January 30, 2016, we had approximately $93 million of unrecognized

share-based compensation expense, which is expected to be recognized over a weighted-average period of 2 years.

F-19