Kohl's 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

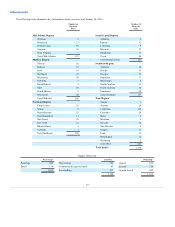

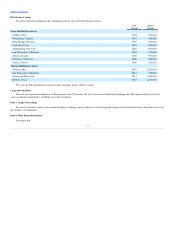

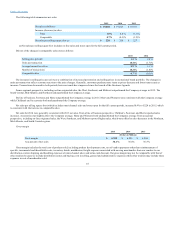

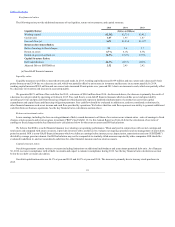

Our current expectations for 2016 are as follows:

Total sales Decrease (0.5%) - Increase 0.5%

Comparable sales Increase 0 - 1%

Gross margin as a percent of sales Increase 0 - 20 bps

Selling, general and administrative expenses Increase 1 - 2%

Depreciation $940 million

Interest $310 million

Effective tax rate 37%

Earnings per diluted share $4.05 - $4.25

Capital expenditures $825 million

Share repurchases:

Total repurchases $600 million

Cost per share $50

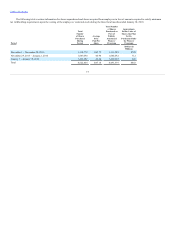

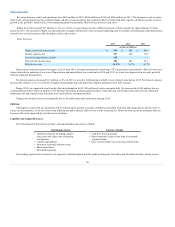

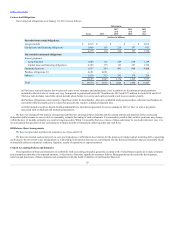

We continue to explore ways to enhance shareholder value through the optimization of our existing store portfolio. In 2016, we intend to close 18

underperforming stores, representing less than one percent of total sales. We announced the specific locations in March. The closures are expected to generate

annual SG&A savings of approximately $45 million and annual depreciation savings of approximately $10 million. We currently expect to incur

approximately $150 - $170 million in charges as a result of these planned closures and the organizational realignment at our corporate offices which were

announced in February. We estimate that approximately $55 - $65 million of the charges will be recorded in the first quarter of 2016, with the remainder

recorded in the second quarter.

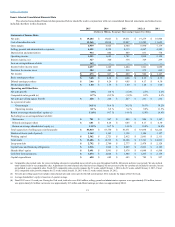

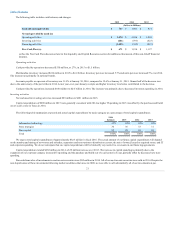

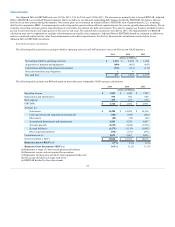

Net Sales

As our omni-channel strategy continues to mature, it is increasingly difficult to distinguish between a "store" sale and an "on-line" sale. Below is a list

of some omni-channel examples:

• Stores increase on-line sales by providing customers opportunities to view, touch and/or try on physical merchandise before ordering on-line.

• On-line purchases can easily be returned in our stores.

• Kohl's Cash coupons and Yes2You rewards can be earned and redeemed on-line or in store regardless of where they were earned.

• In-store customers can order from on-line kiosks in our stores.

• Order on-line and pick-up in store is available in all stores.

• Customers who utilize our mobile app while in the store may receive mobile coupons to use when they check out.

• On-line orders may be shipped from a dedicated on-line fulfillment center, a store, a retail distribution center, direct ship vendors or any combination

of the above.

Because we do not have a clear distinction between "store" sales and "on-line" sales, we do not separately report on-line sales.

Comparable sales include sales for stores (including relocated or remodeled stores) which were open during both the current and prior year periods. We

also include omni-channel sales in our comparable sales. Adjustments for omni-channel sales that have been shipped, but not yet been received by the

customer are included in net sales, but are not included in our comparable sales.

17