Kohl's 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

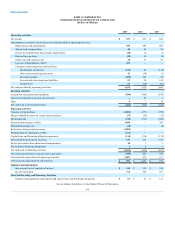

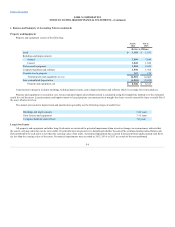

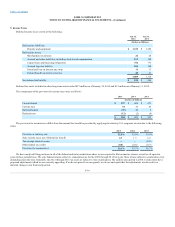

Net income

$ 867

$ 889

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization

886

889

Share-based compensation

48

55

Excess tax benefits from share-based compensation

(3)

(3)

Deferred income taxes

49

(4)

Other non-cash expenses, net

31

43

Loss on extinguishment of debt

—

—

Changes in operating assets and liabilities:

Merchandise inventories

68

(116)

Other current and long-term assets

(30)

(7)

Accounts payable

146

58

Accrued and other long-term liabilities

30

142

Income taxes

(68)

(62)

Net cash provided by operating activities

2,024

1,884

Acquisition of property and equipment

(682)

(643)

Sales of investments in auction rate securities

82

1

Other

7

19

Net cash used in investing activities

(593)

(623)

Treasury stock purchases

(677)

(799)

Shares withheld for taxes on vested restricted shares

(19)

(13)

Dividends paid

(317)

(302)

Proceeds from issuance of debt

—

300

Deferred financing costs

—

(4)

Reduction of long-term borrowings

—

—

Premium paid on redemption of debt

—

—

Capital lease and financing obligation payments

(114)

(115)

Proceeds from stock option exercises

123

102

Excess tax benefits from share-based compensation

3

3

Proceeds from financing obligations

6

1

Net cash used in financing activities

(995)

(827)

Net (decrease) increase in cash and cash equivalents

436

434

Cash and cash equivalents at beginning of period

971

537

Cash and cash equivalents at end of period

$ 1,407

$ 971

Interest paid, net of capitalized interest

$ 329

$ 326

Income taxes paid

502

561

Property and equipment acquired through capital lease and financing obligations

$ 41

$ 121

See accompanying Notes to Consolidated Financial Statements

F-6