Kohl's 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

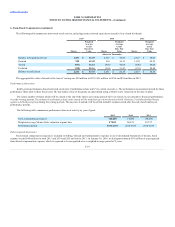

Stock-based compensation expense is generally recognized on a straight-line basis over the vesting period based on the fair value of awards which are

expected to vest. The fair value of all share-based awards is estimated on the date of grant.

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2014-09, "Revenue from Contracts

with Customers (Topic 606)", which supersedes the revenue recognition requirements in ASC No. 605, Revenue Recognition. In August 2015, the FASB

issued ASU 2015-14, "Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date", which defers the effective date of ASU 2014-09

for all entities by one year. The original ASU is based on the principle that revenue is recognized to depict the transfer of goods or services to customers in an

amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. This ASU is effective in the first

quarter of 2018. It will change the way we account for sales returns, our loyalty program and certain promotional programs. Based on current estimates, we do

not expect this ASU to have a material impact on our financial statements and, therefore, we expect to use the modified retrospective method to adopt the

standard.

In February 2016, the FASB issued ASU No. 2016-02, "Leases (Topic 842)". The core principle of the standard is that a lessee should recognize the

assets and liabilities that arise from leases. A lessee should recognize in its statement of financial position a liability to make lease payments (the lease

liability) and a right-of-use asset representing its right to use the underlying asset for the lease term. We will be required to adopt the new standard in the first

quarter of 2019. We are currently evaluating the impact this new standard will have on our financial statements.

During 2015, we adopted ASU No. 2015-03, "Simplifying the Presentation of Debt Issuance Costs (Subtopic 835-30)" which requires us to present debt

issuance costs on the balance sheet as a direct deduction from the related debt liability rather than as an asset. We also adopted ASU No. 2015-17, "Balance

Sheet Classification of Deferred Taxes (Topic 740)" which requires us to present deferred tax liabilities and assets as noncurrent in our balance sheet and

corrected the presentation of certain other tax assets and liabilities.

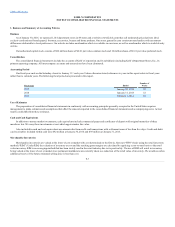

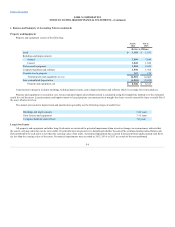

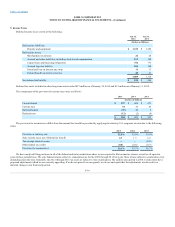

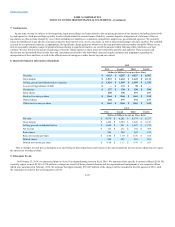

A summary of reclassifications is as follows:

Debt issuance costs

Other current and long-term assets

Long-term debt

$ 18

$ 13

Deferred taxes

Current deferred tax asset

Long-term deferred tax liability

$ 97

$ 84

Deferred taxes

Current deferred tax asset

Other long-term assets

$ 27

$ 32

Deferred taxes

Other long-term liabilities

Long-term deferred tax liability

$ 30

$ 15

F-13