Kohl's 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

.

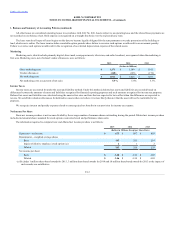

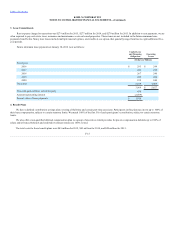

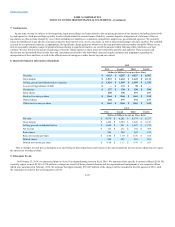

Rent expense charged to operations was $279 million for 2015, $277 million for 2014, and $270 million for 2013. In addition to rent payments, we are

often required to pay real estate taxes, insurance and maintenance costs on leased properties. These items are not included in the future minimum lease

payments listed below. Many store leases include multiple renewal options, exercisable at our option, that generally range from four to eight additional five-

year periods.

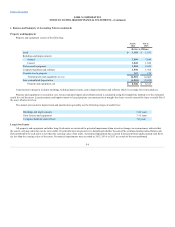

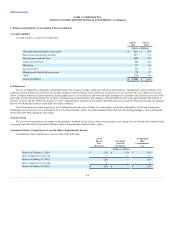

Future minimum lease payments at January 30, 2016 were as follows:

Fiscal year:

2016 $ 293

$ 244

2017 286

245

2018 267

246

2019 249

244

2020 235

240

Thereafter 2,639

4,408

3,969

$ 5,627

Non-cash gain on future sale of property 456

Amount representing interest (2,509)

Present value of lease payments $ 1,916

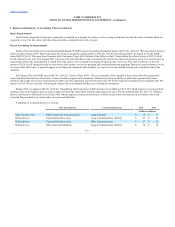

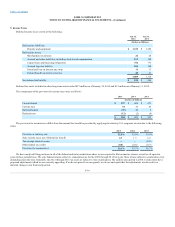

We have a defined contribution savings plan covering all full-time and certain part-time associates. Participants in this plan may invest up to 100% of

their base compensation, subject to certain statutory limits. We match 100% of the first 5% of each participant’s contribution, subject to certain statutory

limits.

We also offer a non-qualified deferred compensation plan to a group of executives which provides for pre-tax compensation deferrals up to 100% of

salary and/or bonus. Deferrals and credited investment returns are 100% vested.

The total costs for these benefit plans were $49 million for 2015, $43 million for 2014, and $49 million for 2013.

F-15