Kohl's 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

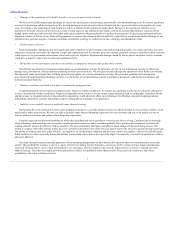

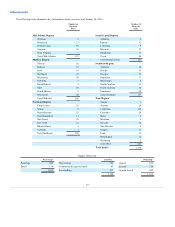

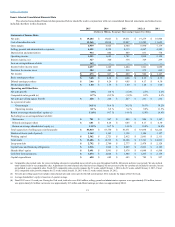

The selected consolidated financial data presented below should be read in conjunction with our consolidated financial statements and related notes

included elsewhere in this document.

(d)

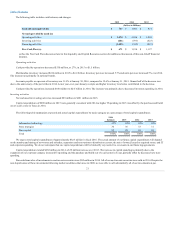

Net sales

$ 19,023

$ 19,031

$ 19,279

$ 18,804

Cost of merchandise sold

12,098

12,087

12,289

11,625

Gross margin

6,925

6,944

6,990

7,179

Selling, general and administrative expenses

4,350

4,313

4,267

4,243

Depreciation and amortization

886

889

833

778

Operating income

1,689

1,742

1,890

2,158

Interest expense, net

340

338

329

299

Loss on extinguishment of debt

—

—

—

—

Income before income taxes

1,349

1,404

1,561

1,859

Provision for income taxes

482

515

575

692

Net income

$ 867

$ 889

$ 986

$ 1,167

Basic earnings per share

$ 4.28

$ 4.08

$ 4.19

$ 4.33

Diluted earnings per share

$ 4.24

$ 4.05

$ 4.17

$ 4.30

Dividends per share

$ 1.56

$ 1.40

$ 1.28

$ 1.00

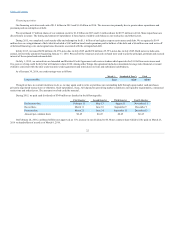

Net sales growth

0.0 %

(1.3)%

2.5%

2.2%

Comparable sales growth (a)

(0.3)%

(1.2)%

0.3%

0.5%

Net sales per selling square foot (b)

$ 226

$ 227

$ 231

$ 232

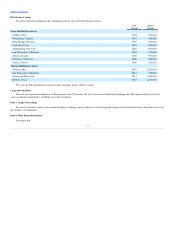

As a percent of sales:

Gross margin

36.4 %

36.5 %

36.3%

38.2%

Operating income

8.9 %

9.2 %

9.8%

11.5%

Return on average shareholders’ equity (c)

14.7 %

14.8 %

15.8%

16.4%

Excluding loss on extinguishment of debt:

Net income

$ 867

$ 889

$ 986

$ 1,167

Diluted earnings per share

$ 4.24

$ 4.05

$ 4.17

$ 4.30

Return on average shareholders' equity (c)

14.7 %

14.8 %

15.8%

16.4%

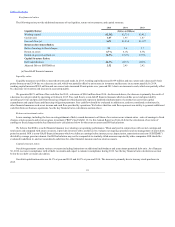

Total square feet of selling space (in thousands)

$ 83,750

$ 83,671

$ 83,098

$ 82,226

Number of stores (end of period)

1,162

1,158

1,146

1,127

Working capital

$ 2,721

$ 2,412

$ 2,061

$ 2,111

Total assets

$ 14,333

$ 14,228

$ 13,761

$ 14,021

Long-term debt

$ 2,780

$ 2,777

$ 2,478

$ 2,128

Capital lease and financing obligations

1,968

$ 2,069

$ 2,061

$ 2,103

Shareholders’ equity

$ 5,991

$ 5,978

$ 6,048

$ 6,508

Cash flow from operations

$ 2,024

$ 1,884

$ 1,265

$ 2,139

Capital expenditures

$ 682

$ 643

$ 785

$ 927

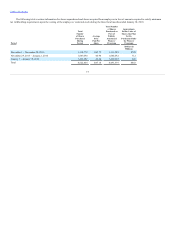

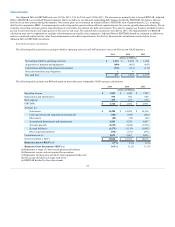

(a) Comparable sales include sales for stores (including relocated or remodeled stores) which were open throughout both the full current and prior year periods. We also include

omni-channel sales in our comparable sales. Adjustments for omni-channel sales that have been shipped, but not yet received by the customer are included in net sales, but are

not included in our comparable sales. Fiscal 2013 comparable sales growth compares the 52 weeks ended February 1, 2014 to the 52 weeks ended February 2, 2013. Fiscal

2012 comparable sales growth compares the 52 weeks ended January 26, 2013 to the 52 weeks ended January 28, 2012.

(b) Net sales per selling square foot includes omni-channel sales and stores open for the full current period. 2012 excludes the impact of the 53rd week.

(c) Average shareholders’ equity is based on a 5-quarter average.

(d) Fiscal 2012 was a 53-week year. During the 53rd week, total sales were $169 million; selling, general and administrative expenses were approximately $30 million; interest

was approximately $2 million; net income was approximately $15 million and diluted earnings per share was approximately $0.06.

15