Kohl's 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

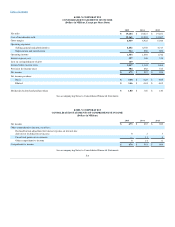

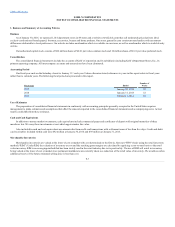

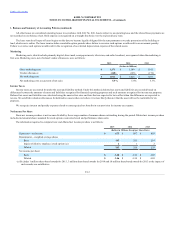

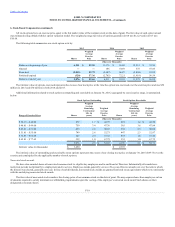

Accrued liabilities consist of the following:

Gift cards and merchandise return cards

$ 307

Payroll and related fringe benefits

135

Sales, property and use taxes

185

Credit card liabilities

106

Marketing

63

Accrued capital

73

Shipping and other distribution costs

27

Other

264

Accrued liabilities

$ 1,160

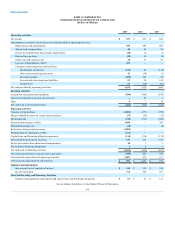

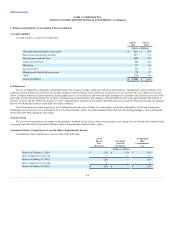

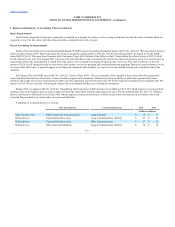

We use a combination of insurance and self-insurance for a number of risks. Liabilities associated with workers’ compensation, general liability, and

employee-related health care benefits losses include estimates of both reported losses and losses incurred but not yet reported. We use a third-party actuary,

which considers historical claims experience, demographic factors, severity factors and other actuarial assumptions, to estimate the liabilities associated with

these risks. Total estimated liabilities for workers’ compensation, general liability and employee-related health benefits were approximately $58 million at

January 30, 2016 and $53 million at January 31, 2015. Although these amounts are actuarially determined based on analysis of historical trends, the amounts

that we will ultimately disburse could differ from these estimates.

Our self insurance exposure for property losses differs based on the type of claim. For catastrophic claims like earthquakes, floods and windstorms,

depending on the location, we are self insured for 2-5% of the insurance claim. For other standard claims like fire and building damages, we are self insured

for the first $250,000 of property loss claims.

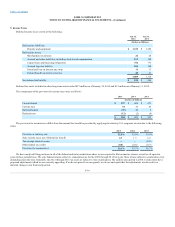

We account for repurchases of common stock and shares withheld in lieu of taxes when restricted stock vests using the cost method with common stock

in treasury classified in the Consolidated Balance Sheets as a reduction of shareholders’ equity.

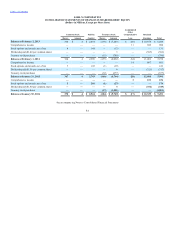

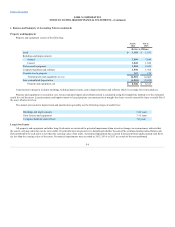

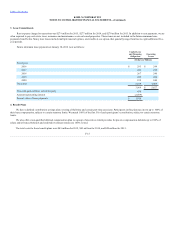

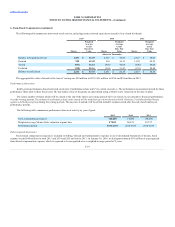

Accumulated other comprehensive loss consists of the following:

Balance at February 1, 2014 $ (23)

$ (11)

$ (34)

Other comprehensive income 3

11

14

Balance at January 31, 2015 (20)

—

(20)

Other comprehensive income

Balance at January 30, 2016

F-9