Kohl's 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

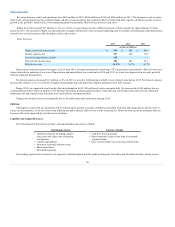

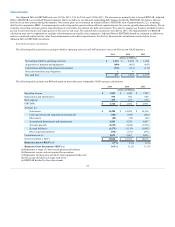

Financing activities

Our financing activities used cash of $1.5 billion in 2015 and $1.0 billion in 2014. The increase was primarily due to greater share repurchases and

premium paid on redemption of debt.

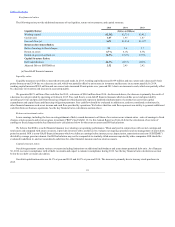

We repurchased 17 million shares of our common stock for $1.0 billion in 2015 and 12 million shares for $677 million in 2014. Share repurchases are

discretionary in nature. The timing and amount of repurchases is based upon available cash balances, our stock price and other factors.

During 2015, we completed a cash tender offer and redemption for $1.1 billion of our higher coupon senior unsecured debt. We recognized a $169

million loss on extinguishment of debt which included a $163 million bond tender premium paid to holders of the debt and a $6 million non-cash write-off

of deferred financing costs and original issue discounts associated with the extinguished debt.

In July 2015, we issued $650 million of 4.25% notes due in July 2025 and $450 million of 5.55% notes due in July 2045. Both notes include semi-

annual, interest-only payments beginning January 17, 2016. Proceeds of the issuances and cash on hand were used to pay the principal, premium and accrued

interest of the acquired and redeemed debt.

On July 1, 2015, we entered into an Amended and Restated Credit Agreement with various lenders which provides for $1.0 billion senior unsecured

five-year revolving credit facility that will mature in June 2020. Among other things, the agreement includes a maximum leverage ratio financial covenant

(which is consistent with the ratio under our prior credit agreement) and restrictions on liens and subsidiary indebtedness.

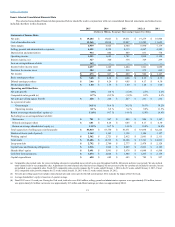

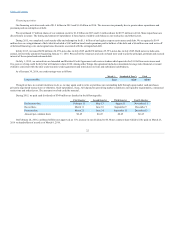

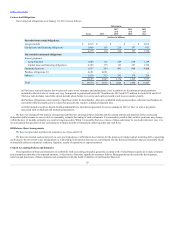

As of January 30, 2016, our credit ratings were as follows:

Long-term debt Baa1 BBB

BBB+

Though we have no current intentions to do so, we may again seek to retire or purchase our outstanding debt through open market cash purchases,

privately negotiated transactions or otherwise. Such repurchases, if any, will depend on prevailing market conditions, our liquidity requirements, contractual

restrictions and other factors. The amounts involved could be material.

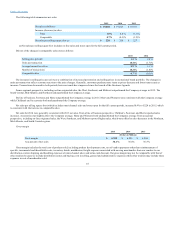

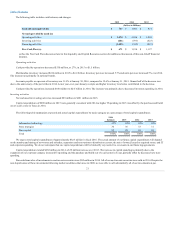

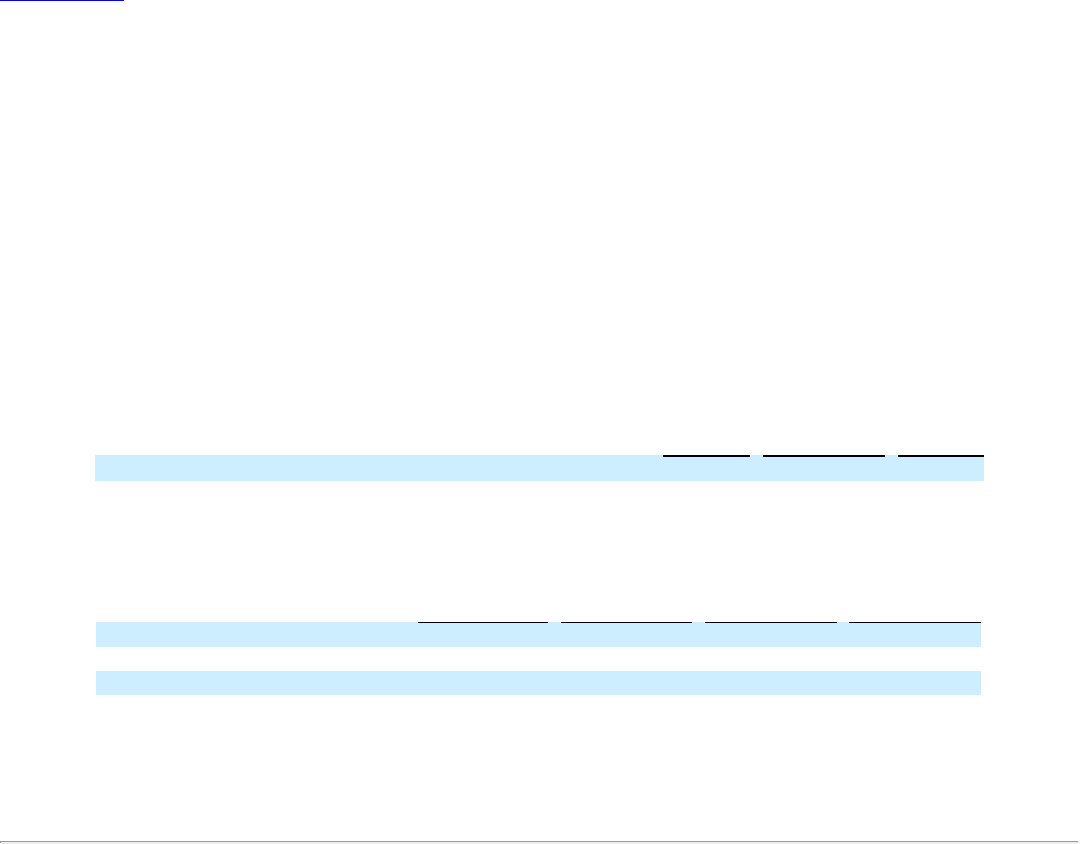

During 2015, we paid cash dividends of $349 million as detailed in the following table:

Declaration date February 25 May 13 August 11 November 11

Record date March 11 June 10 September 9 December 9

Payment date March 25 June 24 September 23 December 23

Amount per common share $0.45 $0.45 $0.45 $0.45

On February 24, 2016, our Board of Directors approved an 11% increase in our dividend to $0.50 per common share which will be paid on March 23,

2016 to shareholders of record as of March 9, 2016.

22