Kohl's 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

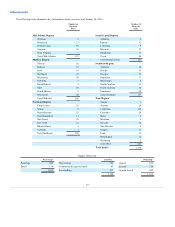

As of January 30, 2016, we operated 1,164 family-focused, value-oriented department stores and a website (www.Kohls.com) that sell moderately-priced

private label, exclusive and national brand apparel, footwear, accessories, beauty and home products. Our stores generally carry a consistent merchandise

assortment with some differences attributable to regional preferences. Our website includes merchandise which is available in our stores, as well as

merchandise which is available only on-line.

In 2014, we introduced a multi-year strategic framework which we refer to as "the Greatness Agenda". It is built on five pillars - amazing product,

incredible savings, easy experience, personalized connections and winning teams. All of the Greatness Agenda initiatives are designed to increase sales,

primarily by increasing the number of customers that shop at our stores and on-line.

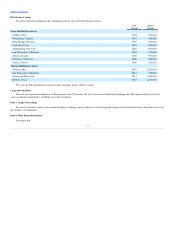

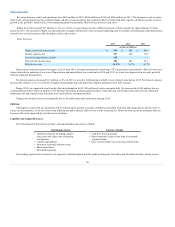

As a retailer, product is the core of our business. During 2015, we increased our emphasis on national brands as we believe they drive customer traffic.

Driven by strong sales in Nike, Skechers, Levi’s and Carters, national brand sales increased 6.2% and represented 52% of our sales in 2015. Active and

wellness merchandise sales were also stronger than the company average in both national brands and our own private and exclusive brands.

During 2015, we expanded our localization assortment strategy which tailors product mix to the specific customer preferences at each of our stores.

Approximately 40% of our sales were tailored by store at the end of 2015. We plan to have unique store assortments in 90% of our stores by the end of 2016.

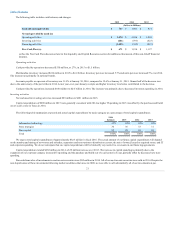

In addition to offering amazing product, we must offer an easy and desirable shopping experience for customers both in our stores and from their digital

devices. During 2015, we launched new mobile and tablet platforms which improved the digital shopping experience. We also launched buy on-line and

pick-up in store (“BOPUS”) in all stores. In addition to offering a convenient shopping option for our customers, BOPUS is driving incremental sales.

Customers picking up BOPUS orders have made additional in-store purchases of approximately 25% of their original order.

In 2016, we plan to make several updates to our store formats and omni-channel strategy. In the first half of the year, we intend to pilot seven new small

format stores which will help inform both future store size and rationalization, and identify omni-channel opportunities. We also plan to test two more

clearance stores, which are operated as Off-Aisle stores, and 12 FILA outlet stores.

We believe our personalized connections and incredible savings strategies will increase sales by strengthening the loyalty of existing customers and

attracting new customers. Key to the success of these initiatives are understanding our customers and ensuring they get the most from every dollar that they

spend at Kohl’s. We believe our Yes2You loyalty program will continue to drive both strategies. In 2015, approximately 65% of our sales were attributed to

Yes2You members. Yes2You members consistently shop more frequently and spend more than customers who are not enrolled in the program.

To execute our Greatness Agenda vision, we rely on winning teams of engaged, talented, results-oriented and empowered management and employees.

During 2015, we rounded out our leadership team by hiring Sona Chawla as our Chief Operating Officer.

We believe that the strategic framework of the Greatness Agenda is working. We are making progress towards our goal of being the most engaging

retailer in America, but realize that it will take additional time to fully implement our initiatives and achieve the goals we initially established.

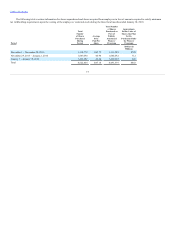

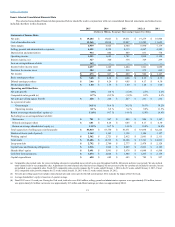

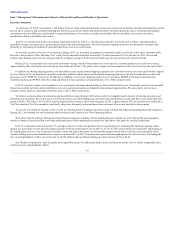

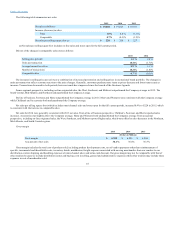

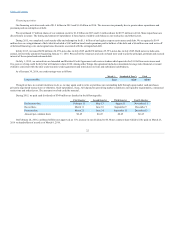

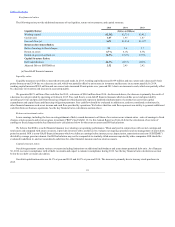

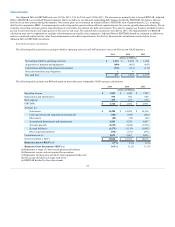

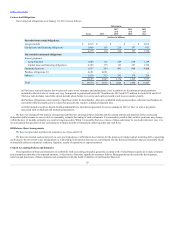

In 2015, comparable sales increased 0.7%; an improvement over the sales declines that we reported prior to launching the Greatness Agenda. Gross

margin as a percentage of sales decreased approximately 30 basis points from 36.4% in 2014 to 36.1% in 2015. Gross margin was especially challenging in

the fourth quarter due to a very competitive holiday season and deeper discounts on cold-weather apparel which did not sell due to unseasonably warm

weather. Selling, general and administrative expenses increased 2% in 2015. Expenses were again well-managed against the sales increases. Excluding the

loss on extinguishment of debt, our net income was $781 million and our diluted earnings per share decreased 5% to $4.01.

See "Results of Operations" and "Liquidity and Capital Resources" for additional details about our financial results, how we define comparable sales,

and the loss on extinguishment of debt.

16