Kodak 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

91

2004 SUMMARY ANNUAL REPORT

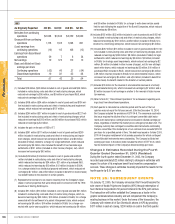

in this subsidiary for approximately $44 million in cash. Due to the timing

of this acquisition, the purchase price allocation was not complete as of

December 31, 2002. Accordingly, the purchase price in excess of the fair

value of the net assets acquired of approximately $18 million was recorded

in other long-term assets in the Company’s 2002 Consolidated Statement

of Financial Position. During 2003, the Company completed the purchase

price allocation. As a result of this allocation, the Company recorded good-

will of approximately $13 million and recognized approximately $5 million in

amortizable intangible assets.

Other During 2002, the Company completed a number of additional

acquisitions with an aggregate purchase price of approximately $14 million,

which were individually immaterial to the Company’s fi nancial position,

results of operations or cash fl ows.

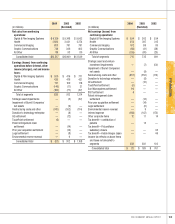

NOTE 22: DISCONTINUED

OPERATIONS

2004

On August 13, 2004, the Company completed the sale of the assets and

business of the Remote Sensing Systems operation, including the stock

of Kodak’s wholly owned subsidiary, Research Systems, Inc. (collectively

known as RSS), to ITT Industries for $725 million in cash. RSS, a leading

provider of specialized imaging solutions to the aerospace and defense

community, was part of the Company’s commercial and government

systems’ operation within the Commercial Imaging segment. Its customers

include NASA, other U.S. government agencies, and aerospace and defense

companies. The sale was completed on August 13, 2004. RSS had net

sales for the years ended December 31, 2004 and 2003 of approximately

$312 million and $424 million, respectively. RSS had earnings before taxes

for the years ended December 31, 2004 and 2003 of approximately $44

million and $66 million, respectively.

The sale of RSS resulted in an after-tax gain of approximately

$439 million. The after-tax gain excludes the potential impacts from any

settlement gains or losses that may be incurred in connection with the

Company’s pension plan of approximately $55 million, as this amount will

be recognized upon fi nal transfer of plan assets, which is expected to occur

during 2005.

The contract with ITT includes a provision under which Kodak may

receive up to $35 million in cash (the “Cash Amount”) from ITT depend-

ing on the amount of pension plan assets that are ultimately transferred

from Kodak’s defi ned benefi t pension plan trust in the U.S. to ITT. The total

amount of assets that Kodak will ultimately transfer to ITT will be actuari-

ally determined in accordance with the applicable sections under the Trea-

sury Regulations and ERISA (the “Transferred Assets”). The Cash Amount

will be equal to 50% of the amount by which the Transferred Assets exceed

the maximum amount of assets that would be required to be transferred

in accordance with the applicable U.S. Government Cost Accounting Stan-

dards (the “CAS Assets”), up to $35 million. Based on preliminary actuarial

valuations, the estimated Cash Amount is approximately $30 million.

Accordingly, the after-tax gain from the sale of RSS includes an estimated

pre-tax amount of $30 million, representing the Company’s estimate of the

Cash Amount that will be received following the transfer of the pension plan

assets to ITT. This amount has been recorded in assets of discontinued

operations in the Company’s Consolidated Statement of Financial Position

as of December 31, 2004. Upon completion of the fi nal actuarial valuation

(expected during 2005), which will determine the Transferred Assets, the

gain will be adjusted accordingly.

Total Company earnings from discontinued operations for the years

ended December 31, 2004 and 2003 of approximately $36 million (exclud-

ing the $439 million RSS after-tax gain) and $64 million, respectively, were

net of provisions for income taxes of $6 million and $10 million, respec-

tively.

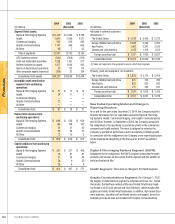

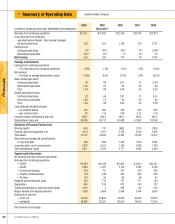

2003

During the three-month period ended March 31, 2003, the Company

repurchased certain properties that were initially sold in connection with

the 1994 divestiture of Sterling Winthrop Inc., which represented a portion

of the Company’s non-imaging health businesses. The repurchase of these

properties allows the Company to directly manage the environmental

remediation that the Company is required to perform in connection with

those properties, which will result in better overall cost control (see Note

11, “Commitments and Contingencies”). In addition, the repurchase elimi-

nated the uncertainty regarding the recoverability of tax benefi ts associated

with the indemnifi cation payments that were previously being made to the

purchaser. Accordingly, the Company reversed a tax reserve of approxi-

mately $15 million through earnings from discontinued operations in the

accompanying Consolidated Statement of Earnings for the twelve months

ended December 31, 2003, which was previously established through

discontinued operations.

During the three month period ended March 31, 2003, the Company

received cash relating to the favorable outcome of litigation associated with

the 1994 sale of Sterling Winthrop Inc. The related gain of $19 million was

recognized in loss from discontinued operations in the Consolidated State-

ment of Earnings for the year ended December 31, 2002. The cash receipt

is refl ected in the net cash provided by (used in) discontinued operations

component in the accompanying Consolidated Statement of Cash Flows for

the year ended December 31, 2003.

During the fourth quarter of 2003, the Company recorded a net of

tax credit of $7 million through discontinued operations for the reversal

of an environmental reserve, which was primarily attributable to positive

developments in the Company’s remediation efforts relating to a formerly

owned manufacturing site in the U.S. In addition, during the fourth quarter

of 2003, the Company reversed state income tax reserves of $3 million, net

of tax, through discontinued operations due to the favorable outcome of tax

audits in connection with a formerly owned business.

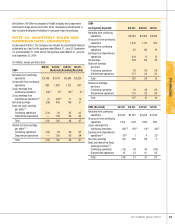

2002

The net loss from discontinued operations of $23 million in the accompa-

nying Consolidated Statement of Earnings for the twelve months ended

December 31, 2002 refl ects losses incurred from the shutdown of Kodak

Global Imaging, Inc., which amounted to $35 million net of tax, partially

offset by net of tax earnings of $12 million related to the favorable outcome

of litigation associated with the 1994 sale of Sterling Winthrop Inc.