Kodak 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

77

2004 SUMMARY ANNUAL REPORT

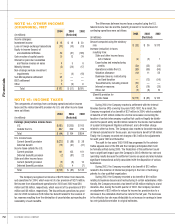

The severance charges of $418 million and the exit costs of $99

million were reported in restructuring costs and other in the accompany-

ing Consolidated Statement of Earnings for the year ended December 31,

2004. Included in the $418 million charge taken for severance costs was a

net curtailment gain of $6 million. This net curtailment gain is disclosed in

Note 17, “Retirement Plans” and Note 18, “Other Postretirement Benefi ts.”

Included in the $99 million charge taken for exit costs was a $16 million

charge for environmental remediation associated with the closures of the

manufacturing facility in Coburg, Australia and Toronto, Canada, and the

closure of a Qualex wholesale photofi nishing lab in the U.S. The liability re-

lated to this charge is disclosed in Note 11, “Commitments and Contingen-

cies” under “Environmental.” During 2004, the Company made $169 million

of severance payments and $47 million of exit cost payments related to

the 2004-2006 Restructuring Program. In the fourth quarter of 2004, the

Company reversed $6 million of severance reserves, as severance pay-

ments were less than originally estimated. The $1 million exit costs reserve

reversal recorded in the third quarter of 2004 resulted from the settlement

of a lease obligation for an amount that was less than originally estimated.

These reserve reversals were included in restructuring costs and other in

the accompanying Consolidated Statement of Earnings for the year ended

December 31, 2004. As a result of the initiatives already implemented

under the 2004-2006 Restructuring Program, severance payments will be

paid during periods through 2007 since, in many instances, the employees

whose positions were eliminated can elect or are required to receive their

payments over an extended period of time. Most exit costs were paid dur-

ing 2004. However, certain costs, such as long-term lease payments, will

be paid over periods after 2004.

As a result of initiatives implemented under the 2004-2006 Re-

structuring Program, the Company recorded $152 million of accelerated

depreciation on long-lived assets in cost of goods sold in the accompany-

ing Consolidated Statement of Earnings for the year ended December 31,

2004. The accelerated depreciation relates to long-lived assets accounted

for under the held and used model of SFAS No. 144. The year-to-date

amount of $152 million relates to $49 million of photofi nishing facilities and

equipment, $102 million of manufacturing facilities and equipment, and

$1 million of administrative facilities and equipment that will be used until

their abandonment. The Company will record approximately $142 million

of additional accelerated depreciation in 2005 related to the initiatives

implemented in 2004. Additional amounts of accelerated depreciation may

be recorded in 2005 and 2006 as the Company continues to execute its

2004-2006 Restructuring Program.

The charges of $826 million recorded in 2004 included $435 million

applicable to the D&FIS segment, $8 million applicable to the Health seg-

ment, $5 million applicable to the Graphic Communications segment and

$2 million applicable to the Commercial Imaging segment. The balance of

$376 million was applicable to manufacturing, research and development,

and administrative functions, which are shared across all segments.

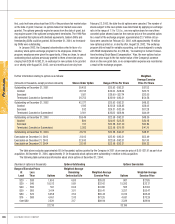

Third Quarter, 2003 Restructuring Program

During the third quarter of 2003, the Company announced its intention to

implement a series of cost reduction actions during the last two quarters

of 2003 and the fi rst two quarters of 2004, which were expected to result

in pre-tax charges totaling $350 million to $450 million. It was anticipated

that these actions would result in a reduction of approximately 4,500 to

6,000 positions worldwide, primarily relating to the rationalization of global

manufacturing assets, reduction of corporate administration and research

and development, and the consolidation of the infrastructure and admin-

istration supporting the Company’s consumer imaging and professional

products and services operations.

The Company implemented certain actions under this Program during

2004. As a result of these actions, the Company recorded charges of $58

million in 2004, which was composed of severance, exit costs, long-lived

asset impairments and inventory write-downs of $45 million, $7 million,

$4 million and $2 million, respectively. The severance costs related to the

elimination of approximately 2,000 positions, including approximately 850

photofi nishing positions, 775 manufacturing positions and 375 administra-

tive positions. The geographic composition of the positions to be eliminated

includes approximately 1,100 in the United States and Canada and 900

throughout the rest of the world. The reduction of the 2,000 positions and

the $52 million charges for severance and exit costs are refl ected in the

Third Quarter, 2003 Restructuring Program table below. The $4 million

charge for long-lived asset impairments was included in restructuring costs

and other in the accompanying Consolidated Statement of Earnings for the

year ended December 31, 2004. The charges taken for inventory write-

downs of $2 million were reported in cost of goods sold in the accompany-

ing Consolidated Statement of Earnings for the year ended December 31,

2004.