Kodak 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

62

E A S T M A N K OD A K C O M PA N Y

periodsaffectedbytheActarepresented.Subsequently,thetotaleffect

onincometaxexpense(orbenefit)foramountsthathavebeenrecognized

undertherepatriationprovisionmustbeprovidedinacompany’sfinan-

cialstatementsfortheperiodinwhichitcompletesitsevaluationofthe

repatriationprovision.TheprovisionsofFSP109-2areeffectiveimmedi-

ately.AsofandfortheyearendedDecember31,2004,theCompanyhas

notyetcompleteditsevaluation;consequently,therequiredinformationis

disclosedinNote15,“IncomeTaxes.”

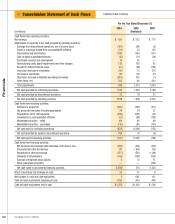

NOTE2:RECEIVABLES,NET

20042003

(inmillions) (Restated)

Tradereceivables $ 2,137 $ 2,002

Miscellaneousreceivables 407 325

Total(netofallowancesof$127and$112) $2,544 $ 2,327

Ofthetotaltradereceivableamountsof$2,137millionand$2,002million

asofDecember31,2004and2003,respectively,approximately$492

millionand$536million,respectively,areexpectedtobesettledthrough

customerdeductionsinlieuofcashpayments.Suchdeductionsrepresent

rebatesowedtothecustomerandareincludedinaccountspayableand

othercurrentliabilitiesintheaccompanyingConsolidatedStatementof

FinancialPositionateachrespectivebalancesheetdate.

NOTE3:INVENTORIES,NET

20042003

(inmillions) (Restated)

AtFIFOoraveragecost

(approximatescurrentcost)

Finishedgoods $ 822 $ 818

Workinprocess 275 300

Rawmaterials 391 328

1,488 1,446

LIFOreserve (330) (368)

Total $ 1,158 $ 1,078

InventoriesvaluedontheLIFOmethodareapproximately35%and

42%oftotalinventoriesin2004and2003,respectively.During2004and

2003,inventoryusageresultedinliquidationsofLIFOinventoryquantities.

Intheaggregate,theseinventorieswerecarriedatthelowercostsprevail-

inginprioryearsascomparedwiththecostofcurrentpurchases.The

effectoftheseLIFOliquidationswastoreducecostofgoodssoldby$69

millionand$45millionin2004and2003,respectively.

TheCompanyreducesthecarryingvalueofinventoriestoalowerof

costormarketbasisforthoseitemsthatarepotentiallyexcess,obsolete

orslow-movingbasedonmanagement’sanalysisofinventorylevelsand

futuresalesforecasts.TheCompanyalsoreducesthecarryingvalueof

inventorieswhosenetbookvalueisinexcessofmarket.Aggregatereduc-

tionsinthecarryingvaluewithrespecttoinventoriesthatwerestillonhand

atDecember31,2004and2003,andthatweredeemedtobeexcess,

obsolete,slow-movingorthathadacarryingvalueinexcessofmarket,

were$100millionand$75million,respectively.

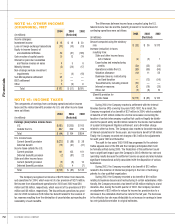

NOTE4:PROPERTY,PLANTAND

EQUIPMENT,NET

(inmillions) 2004 2003

Land $ 118 $ 116

Buildingsandbuildingimprovements 2,619 2,652

Machineryandequipment 9,722 10,144

Constructioninprogress 235 264

12,694 13,176

Accumulateddepreciation (8,182) (8,125)

Netproperties $ 4,512 $ 5,051

Depreciationexpensewas$964million,$839millionand$813mil-

lionfortheyears2004,2003and2002,respectively,ofwhichapproxi-

mately$183million,$70millionand$19million,respectively,represented

accelerateddepreciationinconnectionwithrestructuringactions.