Kodak 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

87

2004 SUMMARY ANNUAL REPORT

NOTE 21: ACQUISITIONS

2004

National Semiconductor Corporation On September 7, 2004, the

Company completed the purchase of the imaging business of National

Semiconductor Corporation, which develops and manufactures compli-

mentary metal oxide semiconductor image sensor (CIS) devices. The

Company paid approximately $10 million cash at closing, which included all

transaction related costs. Under the terms of the acquisition, the Company

acquired certain assets, including intellectual property and equipment, and

hired approximately 50 employees that previously supported the imaging

business. This acquisition added resources and technologies that will fur-

ther strengthen the Company’s ability to design next generation CIS devices

that promise to deliver improved image quality with complex on-chip image

processing circuitry.

Based on the Company’s purchase price allocation, approximately $6

million was assigned to research and development assets that were written

off at the date of acquisition. This amount was determined by identifying

research and development projects that had not yet reached technologi-

cal feasibility and for which no alternative future uses exist. The value of

the projects identifi ed to be in progress was determined by estimating the

future cash fl ows from the projects once commercialized, less costs to

complete development and discounting these net cash fl ows back to their

present value. The discount rate used for these three research and devel-

opment projects was 15%. The charges for the write-off were included as

research and development costs in the Company’s Consolidated Statement

of Earnings for the year ended December 31, 2004.

In addition, approximately $2 million of the purchase price was

included in other long-term assets, as technology-based intangible assets

in the Company’s Consolidate Statement of Financial Position at December

31, 2004. The remaining purchase price was allocated among other current

assets, property, plant, and equipment, and goodwill in the Company’s

Consolidated Statement of Financial Position at December 31, 2004.

NexPress-Related Entities On May 1, 2004, the Company completed

the purchase of Heidelberger Druckmaschinen AG’s (Heidelberg) 50

percent interest in NexPress Solutions LLC, a 50/50 joint venture of Kodak

and Heidelberg that makes high-end, on-demand digital color printing

systems, and the equity of Heidelberg Digital LLC, a leading maker of digital

black-and-white variable-data printing systems. Kodak also announced

the acquisition of NexPress GmbH, a German subsidiary of Heidelberg that

provides engineering and development support, and certain inventory, as-

sets, and employees of Heidelberg’s regional operations or market centers.

There was no consideration paid to Heidelberg at closing. Under the terms

of the acquisition, Kodak and Heidelberg agreed to use a performance-

based earn-out formula whereby Kodak will make periodic payments to

Heidelberg over a two-year period, if certain sales goals are met. If all sales

goals are met during the two calendar years ending December 31, 2005,

the Company will pay a maximum of $150 million in cash. During the fi rst

calendar year, no amounts were paid. Additional payments may also be

made relating to the incremental sales of certain products in excess of a

stated minimum number of units sold during a fi ve-year period following

the closing of the transaction. This acquisition advances the Company’s

strategy of diversifying its business portfolio, and accelerates its participa-

tion in the digital commercial printing industry.

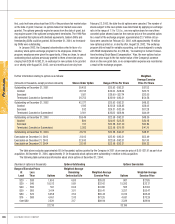

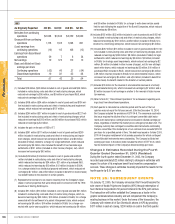

The following table summarizes the estimated fair value of the assets

acquired and liabilities assumed at the date of acquisition. The preliminary

purchase price allocation is as follows:

At May 1, 2004 (in millions)

Current assets $ 95

Intangible assets (including in-process R&D) 9

Other non-current assets (including PP&E) 37

Total assets acquired $ 141

Current liabilities $ 55

Other non-current liabilities 6

Deferred taxes 30

Total liabilities assumed $ 91

Net assets acquired $ 50

The excess of fair value of acquired net assets over cost of $50

million represents negative goodwill and was recorded as a component

of other long-term liabilities in the Company’s Consolidated Statement of

Financial Position.

As of the acquisition date, management began to assess and formu-

late plans to restructure the NexPress-related entities. As of December 31,

2004, management had completed its assessment and approved actions

on some of the plans. Accordingly, the Company recorded a related liability

of $7 million. This liability is included in the current liabilities amount

reported above and represents restructuring charges related to the entities

and net assets acquired. As of December 31, 2004, management had not

approved all plans and actions to be taken and, therefore the Company

was not committed to specifi c actions. Accordingly, the amount related

to future actions is not estimable and has not been recorded. However,

once management approves and commits the Company to the plans, the

accounting for the restructuring charges will be refl ected in the purchase

accounting as a reduction of negative goodwill to the extent the actions

relate to the entities and the net assets acquired. To the extent such actions

relate to the Company’s historical ownership in the NexPress Solutions LLC

joint venture, the restructuring charges will be refl ected in the Company’s

Consolidated Statement of Earnings. This amount was $1.1 million as of

December 31, 2004.

China Lucky Film Co. Ltd. On October 22, 2003, the Company an-

nounced that it signed a twenty-year agreement with China Lucky Film

Corp. On February 10, 2004, the Chinese government approved the

Company’s acquisition of 20 percent of Lucky Film Co. Ltd. (Lucky Film),

the largest maker of photographic fi lm in China, in exchange for total con-

sideration of approximately $167 million. The total consideration of $167

million was composed of $90 million in cash, $40 million in additional net

cash to build and upgrade manufacturing assets, $30 million of contributed

assets consisting of a building and equipment, and $7 million for technical

support and training that the Company will provide to Lucky Film. Under

the twenty-year agreement, Lucky Film will pay Kodak a royalty fee for the

use of certain of the Company’s technologies as well as dividends on the

Lucky Film shares that Kodak will acquire. In addition, Kodak has obtained

a twenty-year manufacturing exclusivity arrangement with Lucky Film as

well as access to Lucky Film’s distribution network.