Kodak 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

76

EASTMAN KODAK COMPANY

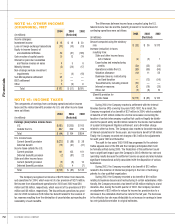

The costs incurred, net of reversals, which total $889 million for the

year ended December 31, 2004, include $183 million and $21 million of

charges related to accelerated depreciation and inventory write-downs,

respectively, which were reported in cost of goods sold in the accompany-

ing Consolidated Statement of Earnings for the year ended December 31,

2004. The remaining costs incurred, net of reversals, of $685 million, were

reported as restructuring costs and other in the accompanying Consoli-

dated Statement of Earnings for the year ended December 31, 2004. The

severance costs and exit costs require the outlay of cash, while long-lived

asset impairments, accelerated depreciation and inventory write-downs

represent non-cash items.

2004-2006 Restructuring Program

In addition to completing the remaining initiatives under the Third Quarter,

2003 Restructuring Program, the Company announced on January 22,

2004 that it planned to develop and execute a comprehensive cost reduc-

tion program throughout the 2004 to 2006 timeframe. The objective of

these actions is to achieve a business model appropriate for the Company’s

traditional businesses, and to sharpen the Company’s competitiveness in

digital markets.

The Program is expected to result in total charges of $1.3 billion

to $1.7 billion over the three-year period, of which $700 million to $900

million are related to severance, with the remainder relating to the disposal

of buildings and equipment. Overall, Kodak’s worldwide facility square

footage is expected to be reduced by approximately one-third. Approxi-

mately 12,000 to 15,000 positions worldwide are expected to be eliminated

through these actions primarily in global manufacturing, selected traditional

businesses and corporate administration. Maximum single year cash usage

under the new program is expected to be approximately $250 million.

The Company implemented certain actions under this program during

2004. As a result of these actions, the Company recorded charges of $674

million in 2004, which was composed of severance, long-lived asset im-

pairments, exit costs and inventory write-downs of $418 million, $138 mil-

lion, $99 million and $19 million, respectively. The severance costs related

to the elimination of approximately 9,625 positions, including approximately

4,700 photofi nishing, 3,575 manufacturing, 425 research and development

and 925 administrative positions. The geographic composition of the posi-

tions to be eliminated includes approximately 5,075 in the United States

and Canada and 4,550 throughout the rest of the world. The reduction of

the 9,625 positions and the $517 million charges for severance and exit

costs are refl ected in the 2004-2006 Restructuring Program table below.

The $138 million charge for long-lived asset impairments was included in

restructuring costs and other in the accompanying Consolidated Statement

of Earnings for the year ended December 31, 2004. The charges taken for

inventory write-downs of $19 million were reported in cost of goods sold in

the accompanying Consolidated Statement of Earnings for the year ended

December 31, 2004.

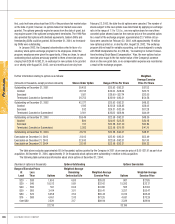

The following table summarizes the activity with respect to the

charges recorded in connection with the focused cost reduction actions

that the Company has committed to under the 2004-2006 Restructuring

Program and the remaining balances in the related reserves at December

31, 2004:

Long-lived Asset

Exit Impairments

Number of Severance Costs and Inventory Accelerated

(dollars in millions) Employees Reserve Reserve Total Write-downs Depreciation

Q1, 2004 charges — $ — $ — $ — $ 1 $ 2

Q1, 2004 utilization — — — — (1) (2)

Balance at 3/31/04 — — — — — —

Q2, 2004 charges 2,700 98 17 115 28 23

Q2, 2004 utilization (800) (12) (11) (23) (28) (23)

Q2, 2004 other adj.

& reclasses — (2) — (2) — —

Balance at 6/30/04 1,900 84 6 90 — —

Q3, 2004 charges 3,200 186 20 206 27 31

Q3, 2004 reversal — — (1) (1) — —

Q3, 2004 utilization (2,075) (32) (14) (46) (27) (31)

Q3, 2004 other adj.

& reclasses — — (5) (5) — —

Balance at 9/30/04 3,025 238 6 244 — —

Q4, 2004 charges 3,725 134 62 196 101 96

Q4, 2004 reversal — (6) — (6) — —

Q4, 2004 utilization (2,300) (125) (22) (147) (101) (96)

Q4, 2004 other adj.

& reclasses — 26 (10) 16 — —

Balance at 12/31/04 4,450 $ 267 $ 36 $ 303 $ — $ —