Kodak 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

59

2 0 0 4 S U M M A R Y A N N U A L R E P O R T

assets.Ifthisreviewindicatesthattheremainingusefullifeofthelong-

livedassethasbeenreduced,theCompanyadjuststhedepreciationonthat

assettofacilitatefullcostrecoveryoveritsrevisedestimatedremaining

usefullife.

DerivativeFinancialInstrumentsTheCompanyaccountsforderivative

financialinstrumentsinaccordancewithSFASNo.133,“Accountingfor

DerivativeInstrumentsandHedgingActivities.”Allderivativeinstruments

arerecognizedaseitherassetsorliabilitiesandaremeasuredatfairvalue.

Certainderivativesaredesignatedandaccountedforashedges.TheCom-

panydoesnotusederivativesfortradingorotherspeculativepurposes.

TheCompanyusescashflowhedgestomanageforeigncurrency

exchangerisk,commoditypricerisk,andinterestrateriskrelatedto

forecastedtransactions.TheCompanyalsousesforeigncurrencyforward

contractstooffsetcurrency-relatedchangesinforeigncurrencydenomi-

natedassetsandliabilities.Theseforeigncurrencyforwardcontractsare

notdesignatedasaccountinghedgesandallchangesinfairvalueare

recognizedinearningsintheperiodofchange.

Thefairvaluesofforeigncurrencyforwardcontractsdesignatedas

cashflowhedgesofforecastedforeigncurrencydenominatedintercom-

panysalesarereportedinothercurrentassetsand/orcurrentliabilities,

andtheeffectiveportionofthegainorlossonthederivativesisrecorded

inothercomprehensiveincome.Whentherelatedinventoryissoldtothird

parties,thehedgegainsorlossesasofthedateoftheintercompanysale

aretransferredfromothercomprehensiveincometocostofgoodssold.

Thefairvaluesofsilverforwardcontractsdesignatedashedgesof

forecastedworldwidesilverpurchasesarereportedinothercurrentassets

and/orcurrentliabilities,andtheeffectiveportionofthegainorlossonthe

derivativeisrecordedinothercomprehensiveincome.Whenthesilver-con-

tainingproductsaresoldtothirdparties,thehedgegainsorlossesasof

thedateofthepurchaseofrawsilveraretransferredfromothercompre-

hensiveincometocostofgoodssold.

EnvironmentalExpendituresEnvironmentalexpendituresthatrelateto

currentoperationsareexpensedorcapitalized,asappropriate.Expendi-

turesthatrelatetoanexistingconditioncausedbypastoperationsand

thatdonotprovidefuturebenefitsareexpensedasincurred.Coststhatare

capitalinnatureandthatprovidefuturebenefitsarecapitalized.Liabilities

arerecordedwhenenvironmentalassessmentsaremadeortherequire-

mentforremedialeffortsisprobable,andthecostscanbereasonably

estimated.Thetimingofaccruingfortheseremediationliabilitiesisgener-

allynolaterthanthecompletionoffeasibilitystudies.

TheCompanyhasanongoingmonitoringandidentificationprocess

toassesshowtheactivities,withrespecttotheknownexposures,are

progressingagainsttheaccruedcostestimates,aswellastoidentifyother

potentialremediationsitesthatarepresentlyunknown.

IncomeTaxesTheCompanyaccountsforincometaxesinaccordance

withSFASNo.109,“AccountingforIncomeTaxes.”Theassetandliability

approachunderlyingSFASNo.109requirestherecognitionofdeferredtax

liabilitiesandassetsfortheexpectedfuturetaxconsequencesoftemporary

differencesbetweenthecarryingamountsandtaxbasisoftheCompany’s

assetsandliabilities.Managementprovidesvaluationallowancesagainst

thenetdeferredtaxassetforamountsthatarenotconsideredmorelikely

thannottoberealized.

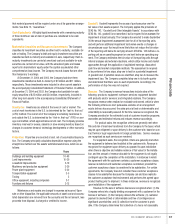

EarningsPerShareInNovember2004,theEmergingIssuesTaskForce

finalizedtheconsensusinIssueNo.04-8,“TheEffectofContingently

ConvertibleDebtonDilutedEarningsperShare”(EITF04-8).EITF04-8

requiresthatcontingentconvertibleinstrumentsbeincludedindiluted

earningspershareregardlessofwhetheramarketpricetriggerorother

contingentfeaturehasbeenmet.EITF04-8iseffectiveforreportingperi-

odsendingafterDecember15,2004andrequiresrestatementofpriorpe-

riods.TheCompanycurrentlyhasapproximately$575millionincontingent

convertiblenotes(theConvertibleSecurities)outstandingthatwereissued

inOctober2003.InterestontheConvertibleSecuritiesaccruesatarate

of3.375%andispayablesemi-annually.TheConvertibleSecuritiesare

convertibleataninitialconversionrateof32.2373sharesoftheCompany’s

commonstockforeach$1,000principaloftheConvertibleSecurities.The

Company’sdilutednetearningspershareincludestheeffectofEITF04-8,

whichhadnomaterialimpactontheCompany’sreporteddilutedearnings

pershare.

Basicearnings-per-sharecomputationsarebasedontheweighted-

averagenumberofsharesofcommonstockoutstandingduringtheyear.

Dilutedearnings-per-sharecalculationsreflecttheassumedexerciseand

conversionofemployeestockoptionsthathaveanexercisepricethatis

belowtheaveragemarketpriceofthecommonsharesfortherespec-

tiveperiodsaswellassharesrelatedtotheassumedconversionofthe

ConvertibleSecurities,ifdilutive.Thereconciliationbetweenthenumerator

anddenominatorofthebasicanddilutedearnings-per-sharecomputations

ispresentedasfollows:

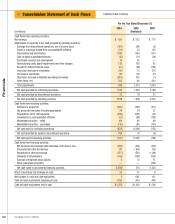

20042003 2002

(Restated)

Numerator:

Earningsfromcontinuing

operationsusedinbasic

netearningspershare $ 81 $189 $ 761

Effectofdilutivesecurities:

Interestexpenseon

contingentconvertible

notes,netoftaxes — 3 —

Earningsfromcontinuing

operationsusedindiluted

netearningspershare $ 81 $192 $ 761

Denominator:

Numberofcommonshares

usedinbasicnet

earningspershare 286.6 286.5 291.5

Effectofdilutivesecurities:

Employeestockoptions 0.2 0.1 0.2

Contingentconvertiblenotes — 4.2 —

Numberofcommonshares

usedindilutednet

earningspershare 286.8 290.8 291.7

Optionstopurchase32.5million,35.9millionand26.8millionshares

ofcommonstockatweighted-averagepersharepricesof$52.47,$51.63

and$58.83fortheyearsendedDecember31,2004,2003and2002,

respectively,wereoutstandingduringtheyearspresentedbutwerenotin-