Kodak 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

66

E A S T M A N K OD A K C O M PA N Y

Annualmaturities(inmillions)oflong-termdebtoutstandingatDe-

cember31,2004areasfollows:$400in2005,$509in2006,$4in2007,

$250in2008,$1in2009and$1,088in2010andbeyond.

InMay2003,theCompanyissuedSeriesAfixedratemedium-term

notesandSeriesAfloatingratemedium-termnotesunderitsthenexisting

debtshelfregistrationtotaling$250millionand$100million,respectively,

asfollows:

(inmillions) Annual

Type Principal InterestRate Maturity

SeriesA $250 3.625% May2008

fixedrate

SeriesA 100 3-month November2005

floatingrate LIBORplus

0.55%

Total $350

Interestonthenoteswillbepaidquarterly,andtheCompanymaynot

redeemorrepaythesenotespriortotheirstatedmaturities.Afterthese

issuances,theCompanyhad$650millionofremainingunsolddebtsecuri-

tiesunderitsthenexistingdebtshelfregistration.

OnSeptember5,2003,theCompanyfiledashelfregistrationstate-

mentonFormS-3(thenewdebtshelfregistration)fortheissuanceofup

to$2,000millionofnewdebtsecurities.Thenewdebtshelfregistration

becameeffectiveonSeptember19,2003.PursuanttoRule429underthe

SecuritiesActof1933,$650millionofremainingunsolddebtsecurities

wereincludedinthenewdebtshelfregistration,givingtheCompanythe

abilitytoissueupto$2,650millioninpublicdebt.

OnOctober10,2003,theCompanycompletedtheofferingandsale

of$500millionaggregateprincipalamountofSeniorNotesdue2013(the

Notes),whichwasmadepursuanttotheCompany’snewdebtshelfregis-

tration.TheremainingunusedbalanceundertheCompany’snewdebtshelf

is$2,150million.ConcurrentwiththeofferingandsaleoftheNotes,on

October10,2003,theCompanycompletedtheprivateplacementof$575

millionaggregateprincipalamountofConvertibleSeniorNotesdue2033

(theConvertibleSecurities)toqualifiedinstitutionalbuyerspursuanttoRule

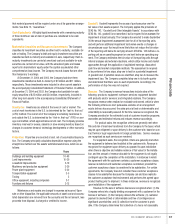

2004 2003

Weighted-Average Amount Weighted-Average Amount

Country Type Maturity InterestRate Outstanding InterestRate Outstanding

U.S. Medium-term 2004 — $ — 1.72%* $ 200

U.S. Medium-term 2005 2.84%* 100 1.73%* 100

U.S. Medium-term 2005 7.25% 200 7.25% 200

U.S. Medium-term 2006 6.38% 500 6.38% 500

U.S. Medium-term 2008 3.63% 249 3.63% 249

U.S. Termnote 2008— — 9.50% 34

U.S. Termnote 2013 7.25% 500 7.25% 500

U.S. Termnote 2018 9.95% 3 9.95% 3

U.S. Termnote 2021 9.20% 10 9.20% 10

U.S. Convertible 2033 3.38% 575 3.38% 575

China Bankloans 2004 — — 5.50% 225

China Bankloans 2005 5.45% 88 5.45% 106

Qualex Notes 2004-2010 5.08% 20 5.53% 49

Other 7 8

$2,252 $2,759

Currentportionoflong-termdebt (400) (457)

Long-termdebt,netofcurrentportion $1,852 $2,302

*Representsdebtwithavariableinterestrate.

FinancialPosition,andtheproceedsfromthesaleofundividedinterests

arerecordedassecuredborrowings.

AstheProgramisrenewableannuallysubjecttothebank’sapproval,

thesecuredborrowingsundertheProgramareincludedinshort-termbor-

rowings.AtDecember31,2004,theCompanyhadnooutstandingsecured

borrowingsundertheProgram.

ThecostofthesecuredborrowingsundertheProgramiscomprised

ofyield,liquidity,conduit,ProgramandProgramagentfees.Theyieldfeeis

subjecttoafloatingrate,basedontheaverageoftheconduits’commercial

paperrates.Thetotalchargeforthesefeesisrecordedininterestexpense.

InterestexpensefortheyearendedDecember31,2004inrelationtothe

Programwasnotmaterial.

TheProgramagreementcontainsanumberofcustomarycovenants

andterminationevents.Upontheoccurrenceofaterminationevent,allse-

curedborrowingsundertheProgramshallbeimmediatelydueandpayable.

TheCompanywasincompliancewithallsuchcovenantsatDecember31,

2004.

Long-TermDebtLong-termdebtandrelatedmaturitiesandinterest

rateswereasfollowsatDecember31,2004and2003(inmillions):