Kodak 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

57

2 0 0 4 S U M M A R Y A N N U A L R E P O R T

thatmaterialpaymentswillberequiredunderanyofitsguaranteearrange-

ments.SeeNote12,“Guarantees.”

CashEquivalentsAllhighlyliquidinvestmentswitharemainingmaturity

ofthreemonthsorlessatdateofpurchaseareconsideredtobecash

equivalents.

MarketableSecuritiesandNoncurrentInvestmentsTheCompany

classifiesitsinvestmentsecuritiesaseitherheld-to-maturity,available-for-

saleortrading.TheCompany’sdebtandequityinvestmentsecuritiesare

classifiedasheld-to-maturityandavailable-for-sale,respectively.Held-to-

maturityinvestmentsarecarriedatamortizedcostandavailable-for-sale

securitiesarecarriedatfairvalue,withtheunrealizedgainsandlosses

reportedinshareholders’equityunderthecaptionaccumulatedother

comprehensive(loss)income.TheCompanyrecordslossesthatareother

thantemporarytoearnings.

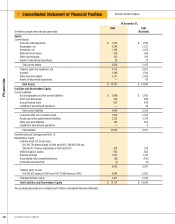

AtDecember31,2004and2003,theCompanyhadshort-term

investmentsclassifiedasheld-to-maturityof$3millionand$11million,

respectively.Theseinvestmentswereincludedinothercurrentassetsin

theaccompanyingConsolidatedStatementofFinancialPosition.Inaddition,

atDecember31,2004and2003,theCompanyhadavailable-for-sale

equitysecuritiesof$25millionand$34million,respectively,includedin

otherlong-termassetsintheaccompanyingConsolidatedStatementof

FinancialPosition.

InventoriesInventoriesarestatedatthelowerofcostormarket.The

costofmostinventoriesintheU.S.isdeterminedbythe“last-in,first-out”

(LIFO)method.ThecostofalloftheCompany’sremaininginventoriesin

andoutsidetheU.S.isdeterminedbythe“first-in,first-out”(FIFO)oraver-

agecostmethod,whichapproximatescurrentcost.TheCompanyprovides

inventoryreservesforexcess,obsoleteorslow-movinginventorybasedon

changesincustomerdemand,technologydevelopmentsorothereconomic

factors.

PropertiesPropertiesarerecordedatcost,netofaccumulateddeprecia-

tion.TheCompanyprincipallycalculatesdepreciationexpenseusingthe

straight-linemethodovertheassets’estimatedusefullives,whichareas

follows:

Years

Buildingsandbuildingequipment 10-40

Landimprovements 10-20

Leaseholdimprovements 3-10

Machineryandproductionequipment 3-20

Powerplantequipment 5-20

Transportationequipment 3-5

Tooling 3

Officeequipment,includingcomputers 3-7

Furnitureandfixtures 3-15

Maintenanceandrepairsarechargedtoexpenseasincurred.Upon

saleorotherdisposition,theapplicableamountsofassetcostandaccumu-

lateddepreciationareremovedfromtheaccountsandthenetamount,less

proceedsfromdisposal,ischargedorcreditedtoincome.

GoodwillGoodwillrepresentstheexcessofpurchasepriceoverthe

fairvalueofnetassetsacquired.TheCompanyappliestheprovisionsof

SFASNo.142,“GoodwillandOtherIntangibleAssets.”Inaccordancewith

SFASNo.142,goodwillisnotamortized,butisrequiredtobeassessedfor

impairmentatleastannually.TheCompanyhaselectedtomakeSeptember

30theannualimpairmentassessmentdateforallofitsreportingunits,

andwillperformadditionalimpairmenttestswheneventsorchangesin

circumstancesoccurthatwouldmorelikelythannotreducethefairvalue

ofthereportingunitbelowitscarryingamount.SFASNo.142definesare-

portingunitasanoperatingsegmentoronelevelbelowanoperatingseg-

ment.TheCompanyestimatesthefairvalueofitsreportingunitsthrough

internalanalysesandexternalvaluations,whichutilizeincomeandmarket

approachesthroughtheapplicationofcapitalizedearnings,discounted

cashflowandmarketcomparablemethods.Theassessmentisrequired

tobeperformedintwosteps,steponetotestforapotentialimpairment

ofgoodwilland,ifpotentiallossesareidentified,steptwotomeasurethe

impairmentloss.TheCompanycompletedsteponeinitsfourthquarter

anddeterminedthattherewerenosuchimpairments.Accordingly,the

performanceofsteptwowasnotrequired.

RevenueTheCompany’srevenuetransactionsincludesalesofthe

following:products;equipment;software;services;equipmentbundled

withproductsand/orservices;andintegratedsolutions.TheCompany

recognizesrevenuewhenrealizedorrealizableandearned,whichiswhen

thefollowingcriteriaaremet:persuasiveevidenceofanarrangement

exists;deliveryhasoccurred;thesalespriceisfixedordeterminable;and

collectibilityisreasonablyassured.Atthetimerevenueisrecognized,the

Companyprovidesfortheestimatedcostsofcustomerincentiveprograms,

warrantiesandestimatedreturnsandreducesrevenueaccordingly.

Forproductsales,therecognitioncriteriaaregenerallymetwhen

titleandriskoflosshavetransferredfromtheCompanytothebuyer,which

maybeuponshipmentorupondeliverytothecustomersite,basedoncon-

tracttermsorlegalrequirementsinforeignjurisdictions.Servicerevenues

arerecognizedassuchservicesarerendered.

Forequipmentsales,therecognitioncriteriaaregenerallymetwhen

theequipmentisdeliveredandinstalledatthecustomersite.Revenueis

recognizedforequipmentupondeliveryasopposedtouponinstallation

whenthereisobjectiveandreliableevidenceoffairvaluefortheinstalla-

tion,andtheamountofrevenueallocabletotheequipmentisnotlegally

contingentuponthecompletionoftheinstallation.Ininstancesinwhich

theagreementwiththecustomercontainsacustomeracceptanceclause,

revenueisdeferreduntilcustomeracceptanceisobtained,providedthe

customeracceptanceclauseisconsideredtobesubstantive.Forcertain

agreements,theCompanydoesnotconsiderthesecustomeracceptance

clausestobesubstantivebecausetheCompanycananddoesreplicate

thecustomeracceptancetestenvironmentandperformstheagreedupon

producttestingpriortoshipment.Intheseinstances,revenueisrecognized

uponinstallationoftheequipment.

Revenueforthesaleofsoftwarelicensesisrecognizedwhen:(1)the

Companyentersintoalegallybindingarrangementwithacustomerforthe

licenseofsoftware;(2)theCompanydeliversthesoftware;(3)customer

paymentisdeemedfixedordeterminableandfreeofcontingenciesor

significantuncertainties;and(4)collectionfromthecustomerisprob-

able.IftheCompanydeterminesthatcollectionofafeeisnotreasonably