Kodak 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

82

EASTMAN KODAK COMPANY

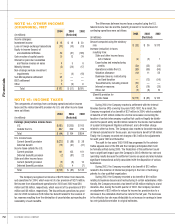

The accumulated benefi t obligations for all the major funded and unfunded U.S. and Non-U.S. defi ned benefi t plans are as follows:

2004 2003

(Restated)

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Accumulated benefi t obligation $ 5,738 $ 3,327 $ 5,685 $ 2,870

Information with respect to the major funded and unfunded U.S. and Non-U.S. defi ned benefi t plans with an accumulated benefi t obligation in excess

of plan assets is as follows:

2004 2003

(Restated)

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Projected benefi t obligation $ 374 $ 3,274 $ 343 $ 2,763

Accumulated benefi t obligation 340 2,983 316 2,520

Fair value of plan assets 79 2,491 67 2,075

Pension expense (income) for all defi ned benefi t plans included:

2004 2003 2002

(Restated)

(in millions) U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Service cost $ 119 $ 38 $ 119 $ 38 $ 106 $ 33

Interest cost 381 169 410 148 421 131

Expected return on plan assets (534) (198) (582) (177) (677) (165)

Amortization of:

Transition obligation (asset) — (1) 2 (2) (54) (3)

Prior service cost 1 (17) 2 (30) 1 (21)

Actuarial loss 28 48 4 31 3 39

(5) 39 (45) 8 (200) 14

Special termination benefi ts — 52 — 30 — 27

Curtailment 8 — — — — —

Settlements — — — 2 — —

Net pension (income) expense 3 91 (45) 40 (200) 41

Other plans including

unfunded plans — 7 — 17 3 49

Total net pension (income) 3 98 (45) 57 (197) 90

expense

Net pension (income) expense

from discontinued operations — — (5) — 6 —

Net pension (income) expense

from continuing operations $ 3 $ 98 $ (50) $ 57 $ (191) $ 90

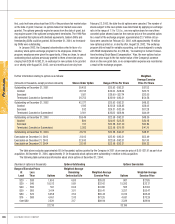

The special termination benefi ts of $52 million, $30 million and $27 million for the years ended December 31, 2004, 2003 and 2002, respectively,

were incurred as a result of the Company’s restructuring actions and, therefore, have been included in restructuring costs and other in the Consolidated

Statement of Earnings.

The Japanese Welfare Pension Insurance Law (JWPIL) was amended in June 2001 to permit employers with Employees’ Pension Funds (EPFs) to

separate the pay related portion of the old-age pension benefi ts under the JWPIL (Substitutional Portion) from the EPF. This obligation and related plan

assets are transferred to a government agency, thereby relieving the EPF from paying the substitutional portion of benefi ts. The Kodak Japan Limited EPF

completed the transfer of the substitutional portion to the Japanese Government in December 2004. The effect of the transfer resulted in a one-time credit

due to the derecognition of future salary increases in the amount of $3 million, a one-time credit due to the government subsidy from the transfer of li-

abilities and related plan assets of $25 million and a one-time charge due to the accelerated recognition of unrecognized loss in accordance with SFAS No.

88 settlement accounting in the amount of $20 million.