Kodak 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

99

2004 SUMMARY ANNUAL REPORT

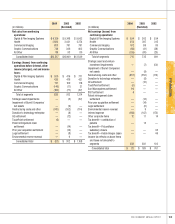

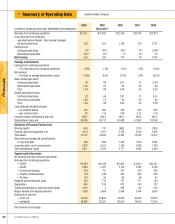

(footnotes for previous page)

(1) Refer to Note 1, “Signifi cant Accounting Policies and Restatement” for a discussion of the restatement of previously issued fi nancial statements.

(2) Includes $889 million of restructuring charges; $16 million of purchased R&D; $12 million for a charge related to asset impairments and other asset write-offs; and a

$6 million charge for a legal settlement Also includes the benefi t of two legal settlements of $101 million. These items reduced net earnings by $609 million.

(3) Includes $552 million of restructuring charges; $31 million of purchased R&D; $7 million for a charge related to asset impairments and other asset write-offs; a $12

million charge related to an intellectual property settlement; $14 million for a charge connected with the settlement of a patent infringement claim; $14 million for a

charge connected with a prior-year acquisition; $9 million for a charge to write down certain assets held for sale following the acquisition of the Burrell Companies; $8

million for a donation to a technology enterprise; an $8 million charge for legal settlements; a $9 million reversal for an environmental reserve; and a $13 million tax

benefi t related to patent donations. These items reduced net earnings by $441 million.

(4) Includes $143 million of restructuring charges; $29 million reversal of restructuring charges; $50 million for a charge related to asset impairments and other asset

write-offs; and a $121 million tax benefi t relating to the closure of the Company’s PictureVision subsidiary, the consolidation of the Company’s photofi nishing opera-

tions in Japan, asset write-offs and a change in the corporate tax rate. These items improved net earnings by $7 million.

(5) Includes $672 million of restructuring charges; $42 million for a charge related to asset impairments associated with certain of the Company’s photofi nishing opera-

tions; $15 million for asset impairments related to venture investments; $41 million for a charge for environmental reserves; $77 million for the Wolf bankruptcy; a

$20 million charge for the Kmart bankruptcy; $18 million of relocation charges related to the sale and exit of a manufacturing facility; an $11 million tax benefi t related

to a favorable tax settlement; and a $20 million tax benefi t representing a decline in the year-over-year effective tax rate. These items reduced net earnings by $590

million.

(6) Includes accelerated depreciation and relocation charges related to the sale and exit of a manufacturing facility of $50 million, which reduced net earnings by $33

million.

(7) Refer to Note 22, “Discontinued Operations” for a discussion regarding the earnings from discontinued operations.