Kodak 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

34

E A S T M A N K OD A K C O M PA N Y

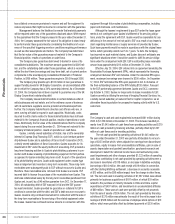

2004 2003

Weighted-Average Amount Weighted-Average Amount

Country Type Maturity InterestRate Outstanding InterestRate Outstanding

U.S. Medium-term 2004 — $ — 1.72%* $ 200

U.S. Medium-term 2005 2.84%* 100 1.73%* 100

U.S. Medium-term 2005 7.25% 200 7.25% 200

U.S. Medium-term 2006 6.38% 500 6.38% 500

U.S. Medium-term 2008 3.63% 249 3.63% 249

U.S. Termnote 2008— — 9.50% 34

U.S. Termnote 2013 7.25% 500 7.25% 500

U.S. Termnote 2018 9.95% 3 9.95% 3

U.S. Termnote 2021 9.20% 10 9.20% 10

U.S. Convertible 2033 3.38% 575 3.38% 575

China Bankloans 2004 — — 5.50% 225

China Bankloans 2005 5.45% 88 5.45% 106

Qualex Notes 2004-2010 5.08% 20 5.53% 49

Other 7 8

$2,252 $2,759

Currentportionoflong-termdebt (400) (457)

Long-termdebt,netofcurrentportion $1,852 $2,302

*Representsdebtwithavariableinterestrate.

TheCompany’sdebtratingsfromeachofthetwomajorratingagen-

ciesdidnotchangeduringtheyearendedDecember31,2004.Moody’s

andStandard&Poors(S&P)ratingsfortheCompany’slong-termdebt

(L/T)andshort-termdebt(S/T),includingtheiroutlooks,asofDecember

31,2004wereasfollows:

L/T S/T Outlook

Moody’s Baa3 P-3 Negative

S&P BBB- A-3 Negative

OnJanuary31,2005,Moody’splaceditsBaa3long-termandP-3

short-termcreditratingsonKodakonreviewforpossibledowngrade,

promptedbytheCompany’sannouncementofitsintentiontoacquire

CreoInc.Moody’smetwiththeCompanyinMarch2005andisstillinthe

processofcompletingtheircreditreview,whichmayincludearevisionto

theirratingsfortheCompany.

OnOctober21,2004,S&PplaceditsBBB-long-termandA-3short-

termcreditratingsonKodakonCreditWatchwithnegativeimplications.

ThisreflectsS&P’sheightenedconcernabouttheCompany’sprofitoutlook

giventherapiddeclineoftheCompany’straditionalphotographysalesand

anuncertainnear-termprofitpotentialfortheconsumerdigitalandgraphic

communicationsbusinessesandtheimpactoftheCompany’sunfunded

postretirementobligations.S&PmetwiththeCompanyinMarch2005and

isstillintheprocessofcompletingtheircreditreview,whichmayincludea

revisiontotheirratingsfortheCompany.

TheCompanynolongerretainsFitchRatingstoprovidecreditratings

ontheCompany’sdebt.Subsequently,onFebruary1,2005,FitchRatings

downgradedtheCompany’sratingstoBB+forlong-termdebtandwith-

drewtheirshort-termdebtrating.Theirratingoutlookremainsnegative.

TheCompanyisincompliancewithallcovenantsorotherrequire-

mentssetforthinitscreditagreementsandindentures.Further,the

Companydoesnothaveanyratingdowngradetriggersthatwouldacceler-

atethematuritydatesofitsdebt,withtheexceptionofthefollowing:the

outstandingborrowings,ifany,undertheaccountsreceivablesecuritization

programiftheCompany’screditratingsfromMoody’sorS&Pweretofall

belowBa2andBB,respectively,andsuchconditioncontinuedforaperiod

of30days.Additionally,theCompanycouldberequiredtoincreasethe

dollaramountofitslettersofcreditorotherfinancialsupportuptoanad-

andanyspecifiedcorporatetransactionoutsideoftheCompany’scontrol

suchasahostiletakeover.Basedonanexternalvaluation,theseembedded

derivativeswerenotmaterialtotheCompany’sfinancialposition,resultsof

operationsorcashflows.

InNovember2004,theEmergingIssuesTaskForcefinalizedthecon-

sensusinIssueNo.04-8,“TheEffectofContingentlyConvertibleDebton

DilutedEarningsperShare”(EITF04-8).EITF04-8requiresthatcontingent

convertibleinstrumentsbeincludedindilutedearningspershareregard-

lessofwhetheramarketpricetriggerorothercontingentfeaturehasbeen

met.EITF04-8iseffectiveforreportingperiodsendingafterDecember15,

2004andrequiresrestatementofpriorperiods.SeeNote1,“Significant

AccountingPolicies,”“EarningsPerShare”forfurtherdiscussion.

Long-termdebtandrelatedmaturitiesandinterestrateswereas

followsatDecember31,2004and2003(inmillions):