Kodak 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

85

2004 SUMMARY ANNUAL REPORT

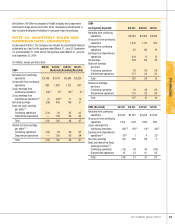

The weighted-average assumptions used to determine the net benefi t

obligations were as follows:

2004 2003

Discount rate 5.75% 6.00%

Salary increase rate 4.25% 4.25%

The weighted-average assumptions used to determine the net postre-

tirement benefi t cost were as follows:

2004 2003

Discount rate 6.00% 6.50%

Salary increase rate 4.25% 4.25%

The weighted-average assumed healthcare cost trend rates used to

compute the other postretirement amounts were as follows:

2004 2003

Healthcare cost trend 10.00% 11.00%

Rate to which the cost trend rate

is assumed to decline (the ultimate

trend rate) 5.00% 5.00%

Year that the rate reaches the

ultimate trend rate 2010 2010

Assumed healthcare cost trend rates have a signifi cant effect on the

amounts reported for the healthcare plans. A one percentage point change

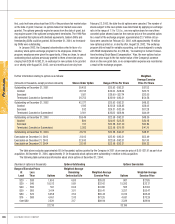

in assumed healthcare cost trend rates would have the following effects:

1% increase 1% decrease

Effect on total service and interest cost $ 6 $ (5)

Effect on postretirement benefi t obligation 103 (88)

The Company expects to contribute $282 million to its other postre-

tirement benefi ts plan in 2005.

The following postretirement benefi ts, which refl ect expected future

service, are expected to be paid.

(in millions) Medicare Part D (U.S.)

2005 $ 282 $ N/A

2006 280 (18)

2007 276 (19)

2008 271 (21)

2009 266 (22)

2010-2014 1,240 (125)

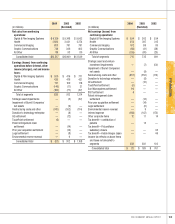

NOTE 19: ACCUMULATED OTHER

COMPREHENSIVE (LOSS) INCOME

The components of accumulated other comprehensive (loss) income at

December 31, 2004, 2003 and 2002 were as follows:

2004 2003 2002

(in millions) (Restated)

Accumulated unrealized holding gains

related to available-for-sale securities $ — $ 11 $ —

Accumulated unrealized losses

related to hedging activity (2) (15) (9)

Accumulated translations adjustments 328 100 (306)

Accumulated minimum pension

liability adjustments (416) (334) (456)

Total $ (90) $ (238) $ (771)

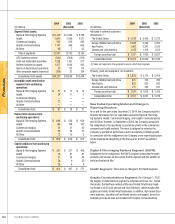

NOTE 20: STOCK OPTION AND

COMPENSATION PLANS

The Company’s stock incentive plans consist of the 2000 Omnibus Long-

Term Compensation Plan (the 2000 Plan), the 1995 Omnibus Long-Term

Compensation Plan (the 1995 Plan), and the 1990 Omnibus Long-Term

Compensation Plan (the 1990 Plan). The Plans are administered by the

Executive Compensation and Development Committee of the Board of

Directors.

Under the 2000 Plan, 22 million shares of the Company’s common

stock may be granted to a variety of employees between January 1, 2000

and December 31, 2004. The 2000 Plan is substantially similar to, and is

intended to replace, the 1995 Plan, which expired on December 31, 1999.

Stock options are generally non-qualifi ed and are at prices not less than

100% of the per share fair market value on the date of grant, and the

options generally expire ten years from the date of grant, but may expire

sooner if the optionee’s employment terminates. The 2000 Plan also pro-

vides for Stock Appreciation Rights (SARs) to be granted, either in tandem

with options or freestanding. SARs allow optionees to receive payment

equal to the increase in the Company’s stock market price from the grant

date to the exercise date. At December 31, 2004, 72,230 freestanding

SARs were outstanding at option prices ranging from $23.25 to $60.50.

Compensation expense recognized in 2004 on those freestanding SARs,

the majority of which had option prices less than the market value of the

Company’s underlying common stock, was not material.

Under the 1995 Plan, 22 million shares of the Company’s common

stock were eligible for grant to a variety of employees between February

1, 1995 and December 31, 1999. Stock options are generally non-qualifi ed

and are at prices not less than 100% of the per share fair market value on

the date of grant, and the options generally expire ten years from the date

of grant, but may expire sooner if the optionee’s employment terminates.

The 1995 Plan also provides for SARs to be granted, either in tandem with

options or freestanding. At December 31, 2004, 316,723 freestanding SARs

were outstanding at option prices ranging from $31.30 to $90.63.

Under the 1990 Plan, 22 million shares of the Company’s common

stock were eligible for grant to key employees between February 1, 1990

and January 31, 1995. The stock options, which were generally non-quali-