Kodak 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

84

EASTMAN KODAK COMPANY

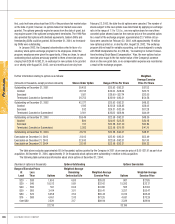

The Company expects to contribute approximately $22 million and

$107 million in 2005 for U.S. and Non-U.S. defi ned benefi t pension plans,

respectively.

The following pension benefi t payments, which refl ect expected future

service, are expected to be paid:

(in millions) U.S. Non-U.S.

2005 $ 434 $ 188

2006 426 187

2007 425 186

2008 425 183

2009 431 177

2010-2014 2,288 894

NOTE 18: OTHER POSTRETIREMENT

BENEFITS

The Company provides healthcare, dental and life insurance benefi ts to U.S.

eligible retirees and eligible survivors of retirees. Generally, to be eligible for

the plan, individuals retiring prior to January 1, 1996 were required to be

55 years of age with ten years of service or their age plus years of service

must have equaled or exceeded 75. For those retiring after December 31,

1995, the individuals must be 55 years of age with ten years of service

or have been eligible as of December 31, 1995. Based on the eligibility

requirements, these benefi ts are provided to U.S. retirees who are covered

by the Company’s KRIP plan and are funded from the general assets of the

Company as they are incurred. However, those under the Cash Balance

Plus portion of the KRIP plan would be required to pay the full cost of their

benefi ts under the plan. The Company’s subsidiaries in the United Kingdom

and Canada offer similar healthcare benefi ts.

During the quarter ended June 30, 2004, the Company adopted

the provisions of FSP 106-2 with respect to its U.S. Postretirement Plan,

which resulted in a remeasurement of the Plan’s accumulated projected

benefi t obligation (APBO) as of April 1, 2004. This remeasurement takes

into account the impact of the subsidy the Company will receive under the

Medicare Prescription Drug, Improvement and Modernization Act of 2003

(the Act) and certain actuarial assumption changes including: (1) changes

in participation rates, (2) a decrease in the Company’s Medicare plan

premiums and (3) a decrease in the discount rate from 6.00% to 5.75%.

The actuarially determined impact of the subsidy reduced the APBO by

approximately $228 million. The effect of the subsidy on the measurement

of the net periodic postretirement benefi t cost was to reduce the cost by

approximately $52 million as follows:

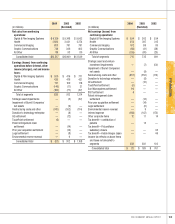

12 months ended

December 31, 2004

Effect of

Effect of Assumption

(in millions) Subsidy Changes Total

Service cost $ — $ 1 $ 1

Interest cost 13 13 26

Amortization of Actuarial gain 17 8 25

$ 30 $ 22 $ 52

The measurement date used to determine the net benefi t obligation

for the Company’s other postretirement benefi t plans is December 31.

Changes in the Company’s benefi t obligation and funded status for

the U.S., United Kingdom and Canada postretirement benefi t plans are as

follows:

2004 2003

(in millions) (Restated)

Net benefi t obligation at beginning of year $ 3,540 $ 3,690

Acquisitions/divestitures (33) —

Service cost 15 16

Interest cost 189 213

Plan participants’ contributions 17 6

Plan amendments (15) (30)

Actuarial gain (82) (117)

Curtailments (17) 1

Settlements (99) —

Benefi t payments (254) (254)

Currency adjustments 9 15

Net benefi t obligation at end of year $ 3,270 $ 3,540

Funded status at end of year $ (3,270) $ (3,540)

Unamortized net actuarial loss 1,188 1,401

Unamortized prior service cost (251) (326)

Net amount recognized and recorded

at end of year $ (2,333) $ (2,465)

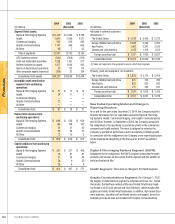

Postretirement benefi t cost for the Company’s U.S., United Kingdom

and Canada postretirement benefi t plans included:

2004 2003 2002

(in millions) (Restated)

Components of net postretirement

benefi t cost

Service cost $ 15 $ 17 $ 16

Interest cost 189 213 213

Amortization of:

Prior service cost (59) (61) (60)

Actuarial loss 85 69 58

230 238 227

Curtailments (63) 1 —

Settlements (64) — —

Total net postretirement benefi t cost $ 103 $ 239 $ 227

Net postretirement benefi t income

from discontinued operations — (1) —

Net postretirement benefi t cost

from continuing operations $ 103 $ 238 $ 227

The U.S. plan represents approximately 97% and 97% of the total

other postretirement net benefi t obligation as of December 31, 2004 and

2003, respectively, and, therefore, the weighted-average assumptions used

to compute the other postretirement benefi t amounts approximate the U.S.

assumptions.