Honeywell 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

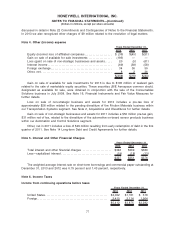

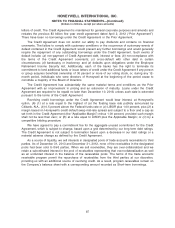

Trade Receivables includes $1,609 and $1,495 million of unbilled balances under long-term

contracts as of December 31, 2013 and December 31, 2012, respectively. These amounts are billed in

accordance with the terms of customer contracts to which they relate.

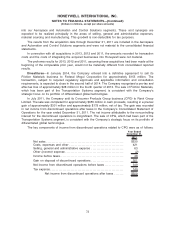

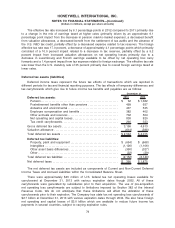

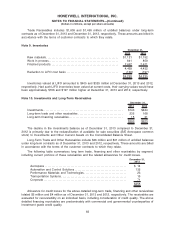

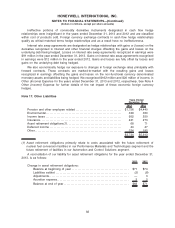

Note 9. Inventories

2013 2012

December 31,

Raw materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,121 $1,152

Work in process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 841 859

Finished products. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,497 2,421

4,459 4,432

Reduction to LIFO cost basis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (166) (197)

$4,293 $4,235

Inventories valued at LIFO amounted to $405 and $325 million at December 31, 2013 and 2012,

respectively. Had such LIFO inventories been valued at current costs, their carrying values would have

been approximately $166 and $197 million higher at December 31, 2013 and 2012, respectively.

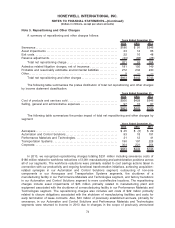

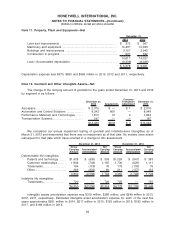

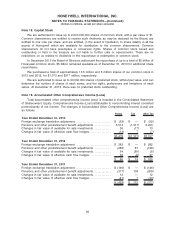

Note 10. Investments and Long-Term Receivables

2013 2012

December 31,

Investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $143 $424

Long-term trade and other receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 235 168

Long-term financing receivables. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 31

$393 $623

The decline in the investments balance as of December 31, 2013 compared to December 31,

2012 is primarily due to the reclassification of available for sale securities (B/E Aerospace common

stock) to Investments and Other Current Assets on the Consolidated Balance Sheet.

Long-Term Trade and Other Receivables include $26 million and $31 million of unbilled balances

under long-term contracts as of December 31, 2013 and 2012, respectively. These amounts are billed

in accordance with the terms of the customer contracts to which they relate.

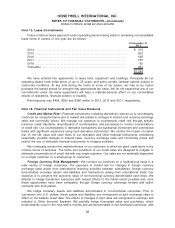

The following table summarizes long term trade, financing and other receivables by segment,

including current portions of these receivables and the related allowances for credit losses.

December 31,

2013

Aerospace . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14

Automation and Control Solutions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 132

Performance Materials and Technologies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Transportation Systems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Corporate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

$255

Allowance for credit losses for the above detailed long-term trade, financing and other receivables

totaled $5 million and $4 million as of December 31, 2013 and 2012, respectively. The receivables are

evaluated for recoverability on an individual basis, including consideration of credit quality. The above

detailed financing receivables are predominately with commercial and governmental counterparties of

investment grade credit quality.

83

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)