Honeywell 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

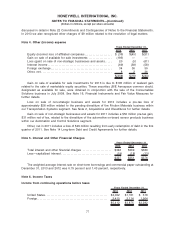

The effective tax rate increased by 6.1 percentage points in 2012 compared to 2011 primarily due

to a change in the mix of earnings taxed at higher rates (primarily driven by an approximate 6.1

percentage point impact from the decrease in pension mark-to-market expense), a decreased benefit

from valuation allowances, a decreased benefit from the settlement of tax audits and the absence of

the U.S. R&D tax credit, partially offset by a decreased expense related to tax reserves. The foreign

effective tax rate was 17.0 percent, a decrease of approximately 4.1 percentage points which primarily

consisted of a 10.0 percent impact related to a decrease in tax reserves, partially offset by a 5.2

percent impact from increased valuation allowances on net operating losses primarily due to a

decrease in Luxembourg and French earnings available to be offset by net operating loss carry

forwards and a 1.4 percent impact from tax expense related to foreign exchange. The effective tax rate

was lower than the U.S. statutory rate of 35 percent primarily due to overall foreign earnings taxed at

lower rates.

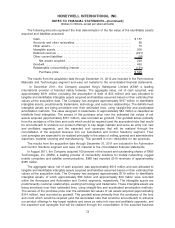

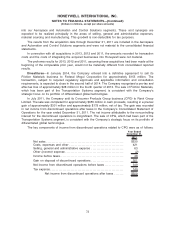

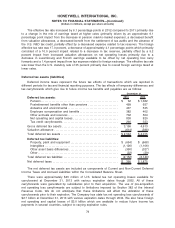

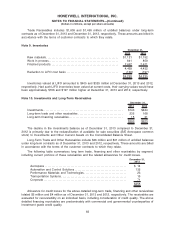

Deferred tax assets (liabilities)

Deferred income taxes represent the future tax effects of transactions which are reported in

different periods for tax and financial reporting purposes. The tax effects of temporary differences and

tax carryforwards which give rise to future income tax benefits and payables are as follows:

Deferred tax assets: 2013 2012

December 31,

Pension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 32 $ 1,362

Postretirement benefits other than pensions . . . . . . . . . . . . . . . . . . . . . . 499 657

Asbestos and environmental . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 437 535

Employee compensation and benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . 382 402

Other accruals and reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 702 504

Net operating and capital losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 838 820

Tax credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 266 333

Gross deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,156 4,613

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (614) (598)

Total deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,542 $ 4,015

Deferred tax liabilities:

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (654) $ (668)

Intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,126) (1,106)

Other asset basis differences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (350) (327)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (22) (39)

Total deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,152) (2,140)

Net deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 390 $ 1,875

The net deferred tax assets are included as components of Current and Non-Current Deferred

Income Taxes and Accrued Liabilities within the Consolidated Balance Sheet.

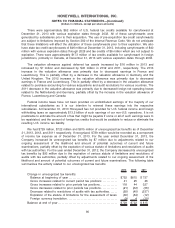

There were approximately $45 million of U.S. federal tax net operating losses available for

carryforward at December 31, 2013 with various expiration dates though 2032. All of these

carryforwards were generated by subsidiaries prior to their acquisition. The use of pre-acquisition

net operating loss carryforwards are subject to limitations imposed by Section 382 of the Internal

Revenue Code. We do not anticipate that these limitations will affect the utilization of these

carryforwards prior to their expiration. The Company has state tax net operating loss carryforwards of

$2.7 billion at December 31, 2013 with various expiration dates through 2034. We also have foreign

net operating and capital losses of $3.0 billion which are available to reduce future income tax

payments in several countries, subject to varying expiration rules.

79

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)