Honeywell 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.volume, pricing and costs. Additionally, valuation allowances related to deferred tax assets can be

impacted by changes to tax laws.

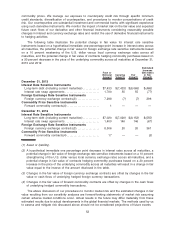

Our net deferred tax asset of $1,004 million consists of $19 million related to U.S. operations and

$985 million related to non-U.S. operations. The U.S. net deferred tax asset of $19 million consists of

federal and state tax credit and net operating loss carryforwards reduced by net taxable temporary

differences. The non-U.S. net deferred tax asset of $985 million consists principally of net deductible

temporary differences, net operating loss, capital loss and tax credit carryforwards, (mainly in Canada,

France, Luxembourg, Netherlands and the United Kingdom). We maintain a valuation allowance of

$614 million against a portion of the non-US net deferred tax assets. The valuation allowance

maintained against these deferred tax assets reflects our historical experience and lower expectations

of taxable income over the applicable carryforward periods. As more fully described in Note 6 to the

financial statements, our valuation allowance increased by $16 million in 2013, increased by $7 million

in 2012 and decreased by $45 million in 2011. In the event we determine that we will not be able to

realize our net deferred tax assets in the future, we will reduce such amounts through a charge to

income in the period such determination is made. Conversely, if we determine that we will be able to

realize net deferred tax assets in excess of the carrying amounts, we will decrease the recorded

valuation allowance through a credit to income in the period that such determination is made.

Significant judgment is required in determining income tax provisions and in evaluating tax

positions. We establish additional reserves for income taxes when, despite the belief that tax positions

are fully supportable, there remain certain positions that do not meet the minimum recognition

threshold. The approach for evaluating certain and uncertain tax positions is defined by authoritative

guidance which determines when a tax position is more likely than not to be sustained upon

examination by the applicable taxing authority. In the normal course of business, the Company and its

subsidiaries are examined by various federal, state and foreign tax authorities. We regularly assess the

potential outcomes of these examinations and any future examinations for the current or prior years in

determining the adequacy of our provision for income taxes. We continually assess the likelihood and

amount of potential adjustments and adjust the income tax provision, the current tax liability and

deferred taxes in the period in which the facts that give rise to a change in estimate become known.

Sales Recognition on Long-Term Contracts—In 2013, we recognized approximately 16 percent

of our total net sales using the percentage-of-completion method for long-term contracts in our

Automation and Control Solutions, Aerospace and Performance Materials and Technologies segments.

These long-term contracts are measured on the cost-to-cost basis for engineering-type contracts and

the units-of-delivery basis for production-type contracts. Accounting for these contracts involves

management judgment in estimating total contract revenue and cost. Contract revenues are largely

determined by negotiated contract prices and quantities, modified by our assumptions regarding

contract options, change orders, incentive and award provisions associated with technical performance

and price adjustment clauses (such as inflation or index-based clauses). Contract costs are incurred

over a period of time, which can be several years, and the estimation of these costs requires

management judgment. Cost estimates are largely based on negotiated or estimated purchase

contract terms, historical performance trends and other economic projections. Significant factors that

influence these estimates include inflationary trends, technical and schedule risk, internal and

subcontractor performance trends, business volume assumptions, asset utilization, and anticipated

labor agreements. Revenue and cost estimates are regularly monitored and revised based on changes

in circumstances. Anticipated losses on long-term contracts are recognized when such losses become

evident. We maintain financial controls over the customer qualification, contract pricing and estimation

processes to reduce the risk of contract losses.

OTHER MATTERS

Litigation

See Note 22 to the financial statements for a discussion of environmental, asbestos and other

litigation matters.

57