Honeywell 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

asset returns and the impact of legislative or regulatory actions related to pension funding obligations.

Payments due under our OPEB plans are not required to be funded in advance, but are paid as

medical costs are incurred by covered retiree populations, and are principally dependent upon the

future cost of retiree medical benefits under our plans. We expect our OPEB payments to approximate

$130 million in 2014 net of the benefit of approximately $11 million from the Medicare prescription

subsidy. See Note 23 to the financial statements for further discussion of our pension and OPEB plans.

The noncontrolling interest shareholder of UOP Russell LLC (formerly Thomas Russell Co.), one

of our subsidiaries, has put rights that may be exercised causing us to purchase their equity interests

beginning January 1, 2016 through December 31, 2016. The same interest is subject to certain call

rights by the Company. As the amount paid is based on operating income performance from 2013 to

2015, the actual settlement amount may be different and has therefore been excluded from this table.

Off-Balance Sheet Arrangements

Following is a summary of our off-balance sheet arrangements:

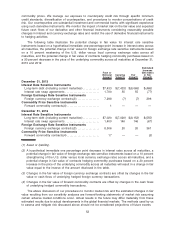

Guarantees—We have issued or are a party to the following direct and indirect guarantees at

December 31, 2013:

Maximum

Potential

Future

Payments

Operating lease residual values . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $40

Other third parties’ financing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Customer financing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

$49

We do not expect that these guarantees will have a material adverse effect on our consolidated

results of operations, financial position or liquidity.

In connection with the disposition of certain businesses and facilities we have indemnified the

purchasers for the expected cost of remediation of environmental contamination, if any, existing on the

date of disposition. Such expected costs are accrued when environmental assessments are made or

remedial efforts are probable and the costs can be reasonably estimated.

Environmental Matters

We are subject to various federal, state, local and foreign government requirements relating to the

protection of the environment. We believe that, as a general matter, our policies, practices and

procedures are properly designed to prevent unreasonable risk of environmental damage and personal

injury and that our handling, manufacture, use and disposal of hazardous substances are in

accordance with environmental and safety laws and regulations. However, mainly because of past

operations and operations of predecessor companies, we, like other companies engaged in similar

businesses, have incurred remedial response and voluntary cleanup costs for site contamination and

are a party to lawsuits and claims associated with environmental and safety matters, including past

production of products containing hazardous substances. Additional lawsuits, claims and costs

involving environmental matters are likely to continue to arise in the future.

With respect to environmental matters involving site contamination, we continually conduct

studies, individually or jointly, with other potentially responsible parties, to determine the feasibility of

various remedial techniques to address environmental matters. It is our policy (see Note 1 to the

financial statements) to record appropriate liabilities for environmental matters when remedial efforts or

damage claim payments are probable and the costs can be reasonably estimated. Such liabilities are

based on our best estimate of the undiscounted future costs required to complete the remedial work.

The recorded liabilities are adjusted periodically as remediation efforts progress or as additional

technical or legal information becomes available. Given the uncertainties regarding the status of laws,

regulations, enforcement policies, the impact of other potentially responsible parties, technology and

information related to individual sites, we do not believe it is possible to develop an estimate of the

50