Honeywell 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2012 compared with 2011

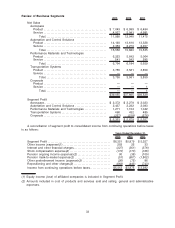

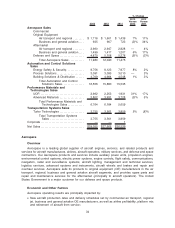

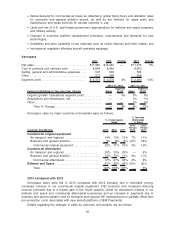

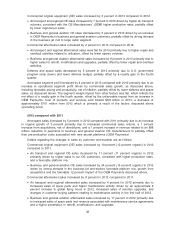

ACS sales increased by 2 percent in 2012 compared with 2011, primarily due to a 3 percent

increase in organic revenue driven by increased sales volume and 1 percent growth from acquisitions,

net of divestitures, partially offset by the unfavorable impact of foreign exchange.

•Sales in our Energy, Safety & Security businesses increased by 2 percent (1 percent organic) in

2012 principally due to (i) the positive impact of acquisitions (most significantly EMS

Technologies, Inc. and King’s Safetywear Limited), net of divestitures, (ii) higher sales volumes

due to contract wins and new product introductions in the scanning and mobility business, (iii)

higher sales volumes due to improved U.S. residential market conditions and new product

introductions in the security business, partially offset by (i) the unfavorable impact of foreign

exchange, (ii) lower sales volume in Europe and (iii) decreases in sales volumes of our personal

protective equipment and sensing and control products primarily the result of softness in

industrial end markets.

•Sales in our Process Solutions business increased 3 percent (6 percent organic) in 2012

principally due to increased conversion to sales from backlog, partially offset by the unfavorable

impact of foreign exchange. Project orders decreased in the second half of 2012 compared to

the corresponding period in 2011 primarily driven by extension of project timing by customers

and higher than typical project orders in the fourth quarter of 2011.

•Sales in our Building Solutions & Distribution businesses increased by 3 percent (4 percent

organic) in 2012 principally due to growth in our Building Solutions business reflecting

conversion to sales from backlog and increased sales volume in our Americas Distribution

business due to improved U.S. residential market conditions, partially offset by the unfavorable

impact of foreign exchange and softness in the energy retrofit business. Project orders

decreased in the fourth quarter of 2012 principally due to extension of project timing by

customers and softness in the energy retrofit business.

ACS segment profit increased by 7 percent in 2012 compared with 2011 due to a 8 percent

increase in operational segment profit and a 1 percent increase from acquisitions, net of divestitures

partially offset by a 2 percent unfavorable impact of foreign exchange. The increase in operational

segment profit is primarily the result of the positive impact from price and productivity, net of inflation.

Cost of products and services sold totaled $10.6 billion in 2012, an increase of $212 million which is

primarily due to higher sales, inflation and acquisitions, net of divestitures partially offset by the

favorable impact of foreign exchange and productivity.

2014 Areas of Focus

ACS’s primary areas of focus for 2014 include:

•Extending technology leadership through continued investment in new product development and

introductions which deliver energy efficiency, lowest total installed cost and integrated solutions;

•Defending and extending our installed base through customer productivity, globalization,

channel optimization and service penetration;

•Sustaining strong brand recognition through our brand and channel management;

•Continuing to identify, execute and integrate acquisitions in or adjacent to the markets which we

serve;

•Continuing to establish and grow presence and capability in high growth regions;

•Continued deployment and optimization of our common ERP system;

•Continued deployment and maturation of HOS; and

•Continued proactive cost actions and successful execution of repositioning actions.

39