Honeywell 2013 Annual Report Download - page 59

Download and view the complete annual report

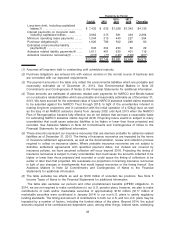

Please find page 59 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.program permit the repurchase of receivables from the third parties at our discretion, providing us with

an additional source of revolving credit. As a result, program receivables remain on the Company’s

balance sheet with a corresponding amount recorded as Short-term borrowings.

In March 2013, the Company repaid $600 million of its 4.25 percent notes.

In November 2013, the Company issued $300 million 3.35 percent Senior Notes due 2023 and

$700 million Floating Rate Senior Notes due 2015 (collectively, the “Notes”). The Notes are senior

unsecured and unsubordinated obligations of Honeywell and rank equally with all of Honeywell’s

existing and future senior unsecured debt and senior to all of Honeywell’s subordinated debt. The

offering resulted in gross proceeds of $1 billion, offset by $7 million in discount and closing costs

related to the offering.

On December 10, 2013, the Company entered into a $4 billion Amended and Restated Five Year

Credit Agreement (“Credit Agreement”) with a syndicate of banks. Commitments under the Credit

Agreement can be increased pursuant to the terms of the Credit Agreement to an aggregate amount

not to exceed $4.5 billion. The Credit Agreement contains a $700 million sublimit for the issuance of

letters of credit. The Credit Agreement is maintained for general corporate purposes and amends and

restates the previous $3 billion five year credit agreement dated April 2, 2012 (“Prior Agreement”).

There have been no borrowings under the Credit Agreement or the Prior Agreement.

During 2013, the Company repurchased $1,073 million of outstanding shares to offset the dilutive

impact of employee stock based compensation plans, including option exercises, restricted unit vesting

and matching contributions under our savings plans (see Part II, Item 5 for share repurchases in the

fourth quarter of 2013). In December 2013, the Board of Directors authorized the repurchase of up to a

total of $5 billion of Honeywell common stock.

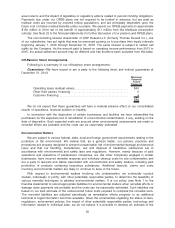

On June 3, 2013, the Company acquired RAE, a global manufacturer of fixed and portable gas

and radiation detection systems, and software. The aggregate value, net of cash acquired, was $338

million. The acquisition was funded with available cash. See Acquisitions in Note 2 to the financial

statements for further discussion.

On September 17, 2013, the Company acquired 100 percent of the issued and outstanding shares

of Intermec, a leading provider of mobile computing, radio frequency identification solutions and bar

code, label and receipt printers for use in warehousing, supply chain, field service and manufacturing

environments. Intermec was a U.S. public company that operated globally and had reported 2012

revenues of $790 million. The aggregate value, net of cash acquired, was $607 million. The acquisition

was funded with the issuance of commercial paper. See Acquisitions in Note 2 to the financial

statements for further discussion.

In January 2014, the Company entered into a definitive agreement to sell its Friction Materials

business to Federal Mogul Corporation for approximately $155 million. The transaction, subject to

required regulatory approvals and applicable information and consultation requirements, is expected to

close in the second half of 2014. See Divestitures in Note 2 to the financial statements for further

discussion.

In 2013, we were not required to make contributions to our U.S. pension plans. During 2013, cash

contributions of $156 million were made to our non-U.S. plans to satisfy regulatory funding standards.

The NARCO Plan of Reorganization went into effect on April 30, 2013. In 2013, the Company

made NARCO Trust establishment payments of $164 million. See Asbestos Matters in Note 22 to the

financial statements for further discussion of possible funding obligations in 2014 related to the

NARCO Trust.

In addition to our normal operating cash requirements, our principal future cash requirements will

be to fund capital expenditures, dividends, strategic acquisitions, share repurchases, employee benefit

obligations, environmental remediation costs, asbestos claims, severance and exit costs related to

repositioning actions and debt repayments.

Specifically, we expect our primary cash requirements in 2014 to be as follows:

47