Honeywell 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

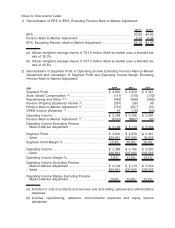

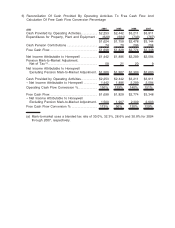

3) Reconciliation Of Cash Provided By Operating Activities To Free Cash Flow And

Calculation Of Free Cash Flow Conversion Percentage (Continued)

($M) 2013

Cash Provided by Operating Activities..................................... $4,335

Expenditures for Property, Plant and Equipment ........................... (947)

$3,388

Cash Pension Contributions . . ............................................ 156

NARCO Trust Establishment Payments ................................... 164

Cash Taxes Relating to the Sale of Available for Sale Investments ......... 100

Free Cash Flow.......................................................... $3,808

Net Income Attributable to Honeywell ..................................... $3,924

Pension Mark-to-Market Adjustment, Net of Tax (a) ......................... 38

Net Income Attributable to Honeywell

Excluding Pension Mark-to-Market Adjustment........................... $3,962

Cash Provided by Operating Activities..................................... $4,335

÷Net Income Attributable to Honeywell ................................... 3,924

Operating Cash Flow Conversion % . ..................................... 110%

Free Cash Flow.......................................................... $3,808

÷Net Income Attributable to Honeywell

Excluding Pension Mark-to-Market Adjustment........................... 3,962

Free Cash Flow Conversion % ........................................... 96%

(a) Mark-to-market uses a blended tax rate of 25.5% in 2013.

This letter contains certain statements that may be deemed “forward-looking statements”

within the meaning of Section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical fact, that address activities, events or developments that

we or our management intends, expects, projects, believes or anticipates will or may occur in

the future are forward-looking statements. Such statements are based upon certain

assumptions and assessments made by our management in light of their experience and

their perception of historical trends, current economic and industry conditions, expected future

developments and other factors they believe to be appropriate. The forward-looking

statements included in this release are also subject to a number of material risks and

uncertainties, including but not limited to economic, competitive, governmental, and

technological factors affecting our operations, markets, products, services and prices. Such

forward-looking statements are not guarantees of future performance, and actual results,

developments and business decisions may differ from those envisaged by such forward-

looking statements.