Honeywell 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.asbestos claimants whose claims were fully resolved during the pendency of the NARCO bankruptcy

proceedings.

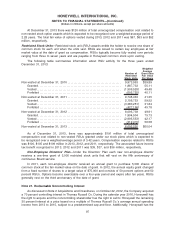

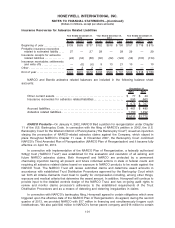

Honeywell is obligated to fund NARCO asbestos claims submitted to the trust which qualify for

payment under the Trust Distribution Procedures, subject to annual caps of $140 million in the years

2014 through 2018 and $145 million for each year thereafter, provided, however, that the first $100

million of claims processed through the NARCO Trust (the “Initial Claims Amount”) will not count

against the first year annual cap and any unused portion of the Initial Claims Amount will roll over to

subsequent years until fully utilized.

Honeywell will also be responsible for the following funding obligations which are not subject to the

annual cap described above: a) previously approved payments due to claimants pursuant to settlement

agreements reached during the pendency of the NARCO bankruptcy proceedings which provide that a

portion of these settlements is to be paid by the NARCO Trust, which amounts are estimated at $130

million and are expected to be paid during the first year of trust operations ($91 million of which was

paid during 2013) and, b) payments due to claimants pursuant to settlement agreements reached

during the pendency of the NARCO bankruptcy proceedings that provide for the right to submit claims

to the NARCO Trust subject to qualification under the terms of the settlement agreements and Trust

Distribution Procedures criteria, which amounts are estimated at $150 million and are expected to be

paid during the first two years of trust operations.

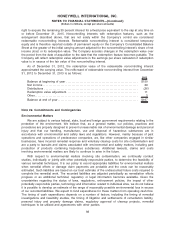

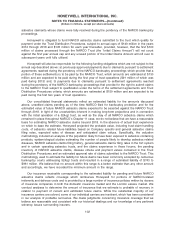

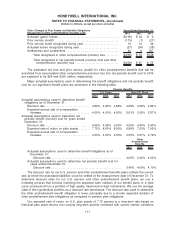

Our consolidated financial statements reflect an estimated liability for the amounts discussed

above, unsettled claims pending as of the time NARCO filed for bankruptcy protection and for the

estimated value of future NARCO asbestos claims expected to be asserted against the NARCO Trust

through 2018. In light of the uncertainties inherent in making long-term projections and in connection

with the initial operation of a 524(g) trust, as well as the stay of all NARCO asbestos claims which

remained in place throughout NARCO’s Chapter 11 case, we do not believe that we have a reasonable

basis for estimating NARCO asbestos claims beyond 2018. In the absence of actual trust experience

on which to base the estimate, Honeywell projected the probable value, including trust claim handling

costs, of asbestos related future liabilities based on Company specific and general asbestos claims

filing rates, expected rates of disease and anticipated claim values. Specifically, the valuation

methodology included an analysis of the population likely to have been exposed to asbestos containing

products, epidemiological studies estimating the number of people likely to develop asbestos related

diseases, NARCO asbestos claims filing history, general asbestos claims filing rates in the tort system

and in certain operating asbestos trusts, and the claims experience in those forums, the pending

inventory of NARCO asbestos claims, disease criteria and payment values contained in the Trust

Distribution Procedures and an estimated approval rate of claims submitted to the NARCO Trust. This

methodology used to estimate the liability for future claims has been commonly accepted by numerous

bankruptcy courts addressing 524(g) trusts and resulted in a range of estimated liability of $743 to

$961 million. We believe that no amount within this range is a better estimate than any other amount

and accordingly, we have recorded the minimum amount in the range.

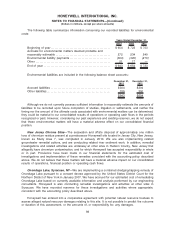

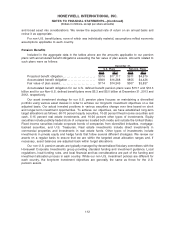

Our insurance receivable corresponding to the estimated liability for pending and future NARCO

asbestos claims reflects coverage which reimburses Honeywell for portions of NARCO-related

indemnity and defense costs and is provided by a large number of insurance policies written by dozens

of insurance companies in both the domestic insurance market and the London excess market. We

conduct analyses to determine the amount of insurance that we estimate is probable of recovery in

relation to payment of current and estimated future claims. While the substantial majority of our

insurance carriers are solvent, some of our individual carriers are insolvent, which has been considered

in our analysis of probable recoveries. We made judgments concerning insurance coverage that we

believe are reasonable and consistent with our historical dealings and our knowledge of any pertinent

solvency issues surrounding insurers.

102

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)