Honeywell 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 15, 2013 (early adoption is permitted). The implementation of the amended accounting

guidance is not expected to have a material impact on our consolidated financial position or results of

operations.

In March 2013, the FASB issued amendments to address the accounting for the cumulative

translation adjustment when a parent either sells a part or all of its investment in a foreign entity or no

longer holds a controlling financial interest in a subsidiary or group of assets that is a nonprofit activity

or a business within a foreign entity. The amendments are effective prospectively for fiscal years (and

interim reporting periods within those years) beginning after December 15, 2013 (early adoption is

permitted). The initial adoption has no impact on our consolidated financial position and results of

operations.

In July 2013, the FASB issued amendments to allow the Federal Funds Effective Swap Rate

(which is the Overnight Index Swap rate, or OIS rate, in the U.S.) to be designated as a benchmark

interest rate for hedge accounting purposes under the derivatives and hedging guidance. The

amendments also allowed for the use of different benchmark rates for similar hedges. The

amendments were effective prospectively for qualifying new or redesignated hedging relationships

entered into on or after July 17, 2013. The initial adoption had no impact on our consolidated financial

position and results of operation.

In July 2013, the FASB issued amendments to guidance on the financial statement presentation of

an unrecognized tax benefit when a net operating loss carryforward, a similar tax loss, or a tax credit

carryforward exists. The amendments require entities to present an unrecognized tax benefit netted

against certain deferred tax assets when specific requirements are met. However, the amendments

only affect gross versus net presentation and do not impact the calculation of the unrecognized tax

benefit. The amendments are effective for fiscal years, and interim periods within those years,

beginning after December 15, 2013 (early adoption is permitted). The implementation of the amended

accounting guidance is not expected to have a material impact on our consolidated financial position.

Note 2. Acquisitions and Divestitures

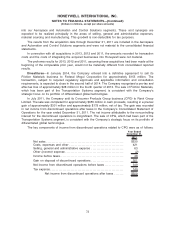

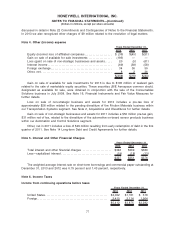

Acquisitions—We acquired businesses for an aggregate cost (net of cash acquired) of $1,133

million, $438 million, and $973 million in 2013, 2012 and 2011, respectively. For all of our acquisitions

the acquired businesses were recorded at their estimated fair values at the dates of acquisition.

Significant acquisitions made in these years are discussed below.

On September 17, 2013, the Company acquired 100 percent of the issued and outstanding shares

of Intermec, a leading provider of mobile computing, RFID and bar code, label and receipt printers for

use in warehousing, supply chain, field service and manufacturing environments. Intermec was a U.S.

public company that operated globally and had reported 2012 revenues of $790 million.

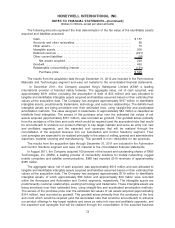

The aggregate value, net of cash acquired, was $607 million and was allocated to tangible and

identifiable intangible assets acquired and liabilities assumed based on their estimated fair values at

the acquisition date. On a preliminary basis, the Company has assigned $257 million to identifiable

intangible assets, predominantly customer relationships, existing technology and trademarks. These

intangible assets are being amortized over their estimated lives which range from 4 to 15 years using

straight-line and accelerated amortization methods. The excess of the purchase price over the

estimated fair values of net assets acquired (approximating $349 million), was recorded as goodwill.

This goodwill arises primarily from the avoidance of the time and costs which would be required (and

the associated risks that would be encountered) to enhance our product offerings to key target markets

and enter into new and profitable segments, and the expected cost synergies that will be realized

through the consolidation of the acquired business within our Automation and Control Solutions

segment. The goodwill is non-deductible for tax purposes.

70

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)