Honeywell 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

into our Aerospace and Automation and Control Solutions segments. These cost synergies are

expected to be realized principally in the areas of selling, general and administrative expenses,

material sourcing and manufacturing. This goodwill is non-deductible for tax purposes.

The results from the acquisition date through December 31, 2011 are included in the Aerospace

and Automation and Control Solutions segments and were not material to the consolidated financial

statements.

In connection with all acquisitions in 2013, 2012 and 2011, the amounts recorded for transaction

costs and the costs of integrating the acquired businesses into Honeywell were not material.

The proforma results for 2013, 2012 and 2011, assuming these acquisitions had been made at the

beginning of the comparable prior year, would not be materially different from consolidated reported

results.

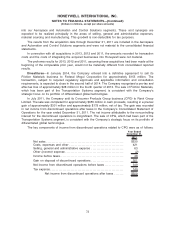

Divestitures—In January 2014, the Company entered into a definitive agreement to sell its

Friction Materials business to Federal Mogul Corporation for approximately $155 million. The

transaction, subject to required regulatory approvals and applicable information and consultation

requirements, is expected to close in the second half of 2014. The Company recognized a pre-tax and

after-tax loss of approximately $28 million in the fourth quarter of 2013. The sale of Friction Materials,

which has been part of the Transportation Systems segment, is consistent with the Company’s

strategic focus on its portfolio of differentiated global technologies.

In July 2011, the Company sold its Consumer Products Group business (CPG) to Rank Group

Limited. The sale was completed for approximately $955 million in cash proceeds, resulting in a pre-tax

gain of approximately $301 million and approximately $178 million, net of tax. The gain was recorded

in net income from discontinued operations after taxes in the Company’s Consolidated Statement of

Operations for the year ended December 31, 2011. The net income attributable to the noncontrolling

interest for the discontinued operations is insignificant. The sale of CPG, which had been part of the

Transportation Systems segment, is consistent with the Company’s strategic focus on its portfolio of

differentiated global technologies.

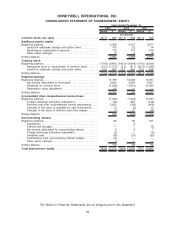

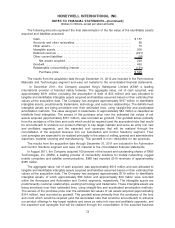

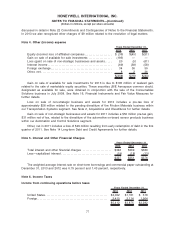

The key components of income from discontinued operations related to CPG were as of follows:

2011

Year Ended

December 31,

Net sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $530

Costs, expenses and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 421

Selling, general and administrative expense . . . . . . . . . . . . . . . . . . . . . . . . 63

Other (income) expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2)

Income before taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

Gain on disposal of discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . 301

Net income from discontinued operations before taxes . . . . . . . . . . . . . . 349

Tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140

Net income from discontinued operations after taxes . . . . . . . $209

73

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)