Honeywell 2013 Annual Report Download - page 81

Download and view the complete annual report

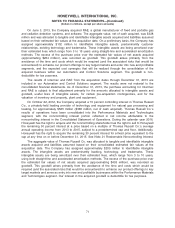

Please find page 81 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In May 2011, the FASB issued amendments to clarify the application of existing fair value

measurements and expand existing disclosure requirements. These amendments, effective for the

interim and annual periods beginning on or after December 15, 2011 (early adoption was prohibited),

resulted in a common definition of fair value and common requirements for measurement of and

disclosure requirements between U.S. GAAP and International Financial Reporting Standards. The

implementation of the amended accounting guidance did not have a material impact on our

consolidated financial position or results of operations.

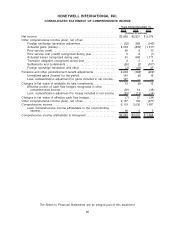

In June 2011, the FASB issued amendments to disclosure requirements for presentation of

comprehensive income. This guidance, effective retrospectively for the interim and annual periods

beginning on or after December 15, 2011 (early adoption was permitted), required presentation of total

comprehensive income, the components of net income, and the components of other comprehensive

income either in a single continuous statement of comprehensive income or in two separate but

consecutive statements. In December 2011, the FASB issued an amendment to defer the presentation

on the face of the financial statements the effects of reclassifications out of accumulated other

comprehensive income on the components of net income and other comprehensive income for annual

and interim financial statements. The implementation of the amended accounting guidance did not

have a material impact on our consolidated financial position or results of operations. In February

2013, the FASB issued amendments to disclosure requirements for presentation of comprehensive

income. The standard required presentation (either in a single note or parenthetically on the face of the

financial statements) of the effect of significant amounts reclassified from each component of

accumulated other comprehensive income based on its source and the income statement line items

affected by the reclassification. If a component was not required to be reclassified to net income in its

entirety, a cross reference to the related footnote for additional information would be required. The

amendments were effective prospectively for reporting periods beginning after December 15, 2012

(early adoption was permitted). Since these amendments to accounting guidance impacted

presentation and disclosure requirements only, their adoption did not have a material impact on our

consolidated financial position or results of operations.

In September 2011, the FASB issued amendments to the goodwill impairment guidance which

provided an option for companies to use a qualitative approach to test goodwill for impairment if certain

conditions were met. The amendments were effective for annual and interim goodwill impairment tests

performed for fiscal years beginning after December 15, 2011 (early adoption was permitted). The

implementation of the amended accounting guidance did not have a material impact on our

consolidated financial position or results of operations.

In July 2012, the FASB issued amendments to the indefinite-lived intangible asset impairment

guidance which provided an option for companies to use a qualitative approach to test indefinite-lived

intangible assets for impairment if certain conditions were met. The amendments were effective for

annual and interim indefinite-lived intangible asset impairment tests performed for fiscal years

beginning after September 15, 2012. The implementation of the amended accounting guidance did not

have a material impact on our consolidated financial position or results of operations.

In February 2013, the FASB issued amendments to guidance for obligations resulting from joint

and several liability arrangements. The amended guidance requires an entity to measure obligations

resulting from joint and several liability arrangements for which the sum of (1) the amount of the

obligation within the scope of this guidance is fixed at the reporting date, as the amount the reporting

entity agreed to pay on the basis of its arrangement among its co-obligors and (2) any additional

amount the reporting entity expects to pay on behalf of its co-obligors. The guidance also requires an

entity to disclose the nature and amount of the obligation as well as other information about those

obligations. The amendments should be applied retrospectively to all prior periods presented for

obligations within the scope of guidance that exist at the beginning of an entity’s fiscal year of adoption.

The amendments are effective for fiscal years, and interim periods within those years, beginning after

69

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)