Honeywell 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

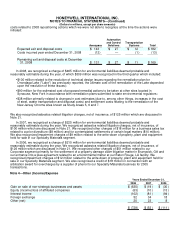

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

In September 2008, the FASB ratified EITF Issue No. 08-5, "Issuer's Accounting for Liabilities Measured at

Fair Value With a Third-Party Credit Enhancement" (EITF 08-5). EITF 08-5 provides guidance for measuring

liabilities issued with an attached third-party credit enhancement (such as a guarantee). It clarifies that the issuer

of a liability with a third-party credit enhancement (such as a guarantee) should not include the effect of the credit

enhancement in the fair value measurement of the liability. EITF 08-5 is effective for the first reporting period

beginning after December 15, 2008. The implementation of this standard will not have a material impact on our

consolidated financial position and results of operations.

In November 2008, the FASB ratified EITF Issue No. 08-6, "Equity method Investment Accounting

Considerations" (EITF 08-6). EITF 08-6 addresses a number of matters associated with the impact of SFAS No.

141R and SFAS No. 160 on the accounting for equity method investments including initial recognition and

measurement and subsequent measurement issues. EITF 08-6 is effective, on a prospective basis, for fiscal

years beginning after December 15, 2008 and interim periods within those fiscal years. The implementation of

this standard will not have a material impact on our consolidated financial position and results of operations.

In November 2008, the FASB ratified EITF Issue No. 08-07, "Accounting for Defensive Intangible Assets"

(EITF 08-7). EITF 08-7 provides guidance for accounting for defensive intangible assets subsequent to their

acquisition in accordance with SFAS No. 141R and SFAS No. 157 including the estimated useful life that should

be assigned to such assets. EITF 08-7 is effective for intangible assets acquired on or after the beginning of the

first annual reporting period beginning on or after December 15, 2008. The Company is currently assessing the

impact of EITF 08-7 on its consolidated financial position and results of operations.

In November 2008, the FASB ratified EITF Issue No. 08-08, "Accounting for an Instrument (or an Embedded

Feature) with a Settlement Amount That Is Based on the Stock of an Entity's Consolidated Subsidiary" (EITF

08-8). EITF 08-8 clarifies whether a financial instrument for which the payoff to the counterparty is based, in

whole or in part, on the stock of an entity's consolidated subsidiary is indexed to the reporting entity's own stock.

EITF 08-8 is effective fiscal years beginning on or after December 15, 2008, and interim periods within those

fiscal years. The implementation of this standard will not have a material impact on our consolidated financial

position and results of operations.

In December 2008, the FASB issued FSP FAS 140-4 and FIN 46(R)-8, "Disclosures by Public Entities

(Enterprises) about Transfers of Financial Assets and Interests in Variable Interest Entities" (FSP 140-4 and

46(R)-8). FSP 140-4 and 46(R)-8 requires additional disclosures about transfers of financial assets and

involvement with variable interest entities. FSP 140-4 and 46(R)-8 is effective for the first reporting period (annual

or interim) ending after December 15, 2008. The implementation of this standard did not have a material impact

on our consolidated financial position and results of operations.

In December 2008, the FASB issued FSP 132(R)-1, "Employers' Disclosures about Postretirement Benefit

Plan Assets" (FSP 132(R)-1). FSP 132(R)-1 provides guidance on an employer's disclosures about plan assets

of a defined benefit pension or other postretirement plan. FSP 132(R)-1 is effective for fiscal years ending after

December 15, 2009. The implementation of this standard will not have a material impact on our consolidated

financial position and results of operations.

In January 2009, the FASB issued FSP EITF 99-20-1, "Amendments to the Impairment Guidance of EITF

Issue No. 99-20" (FSP 99-20-1). FSP 99-20-1 amends the impairment guidance in EITF Issue No. 99-20,

"Recognition of Interest Income and Impairment on Purchased Beneficial Interests and Beneficial Interests That

Continue to Be Held by a Transferor in Securitized Financial Assets," to achieve more consistent determination of

whether an other-than-temporary impairment has occurred. FSP 99-20-1 is effective, on a prospective basis, for

interim and annual reporting periods ending after December 15, 2008. The implementation of this standard did

not have a material impact on our consolidated financial position and results of operations.

61