Hasbro 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

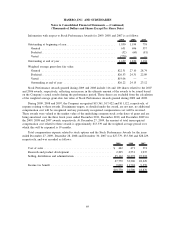

During the year ended December 27, 2009, the Company reclassified net gains from other comprehensive

earnings to net earnings of $21,240. Of the amount reclassified in 2009, $17,173 was reclassified to cost of

sales and $4,785 was reclassified to royalty expense. In addition, net losses of $(718) were reclassified to

earnings as a result of hedge ineffectiveness in 2009.

Undesignated Hedges

The Company also enters into foreign currency forward contracts to minimize the impact of changes in

the fair value of intercompany loans due to foreign currency changes. Due to the short-term nature of the

derivative contracts involved, the Company does not use hedge accounting for these contracts. As of

December 27, 2009, the total notional amount of the Company’s undesignated derivative instruments was

$94,926.

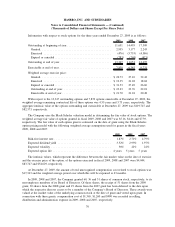

At December 27, 2009, the fair values of the Company’s undesignated derivative financial instruments are

recorded in prepaid expenses and other current assets in the consolidated balance sheet as follows:

Unrealized gains ........................................................ $ 747

Unrealized losses ....................................................... (2,151)

Net unrealized loss ...................................................... $(1,404)

The Company recorded net gains (losses) of $6,580, $(42,382) and $(2,098) on these instruments to other

(income) expense, net for 2009, 2008 and 2007, respectively, relating to the change in fair value of such

derivatives, substantially offsetting gains and losses from the change in fair value of intercompany loans to

which the contracts relate.

For additional information related to the Company’s derivative financial instruments see notes 2, 8 and 11.

(16) Commitments and Contingencies

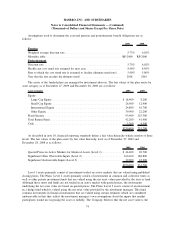

Hasbro had unused open letters of credit and related instruments of approximately $135,277 and

$100,700 at December 27, 2009 and December 28, 2008, respectively.

The Company enters into license agreements with inventors, designers and others for the use of

intellectual properties in its products. Certain of these agreements contain provisions for the payment of

guaranteed or minimum royalty amounts. Additionally, the Company has a long-term commitment related to

promotional and marketing activities at a U.S. based theme park. Under terms of existing agreements as of

December 27, 2009, Hasbro may, provided the other party meets their contractual commitment, be required to

pay amounts as follows: 2010: $32,761; 2011: $36,804; 2012: $61,926; 2013: $85,000; 2014: $14,375; and

thereafter: $100,625. At December 27, 2009, the Company had $120,115 of prepaid royalties, $43,115 of

which are included in prepaid expenses and other current assets and $77,000 of which are included in other

assets.

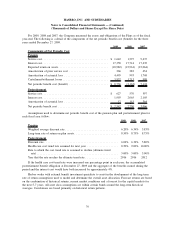

In addition to the above commitments, certain of the above contracts impose minimum marketing

commitments on the Company. The Company may be subject to additional royalty guarantees totaling

$140,000 that are not included in the amounts above that may be payable during the next five to six years

contingent upon the quantity and types of theatrical movie releases.

In connection with the Company’s agreement to form a joint venture with Discovery, the Company is

obligated to make future payments to Discovery under a tax sharing agreement. The Company estimates these

payments may total approximately $139,000 and may range from approximately $3,000 to $7,000 per year

during the period 2010 to 2014, and approximately $110,000 in aggregate for all years occurring thereafter.

79

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)