Hasbro 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

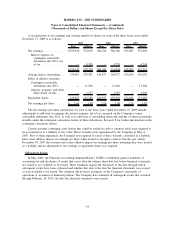

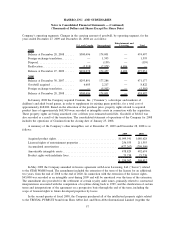

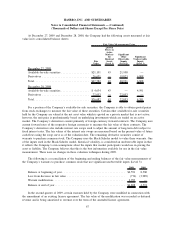

A reconciliation of the statutory United States federal income tax rate to Hasbro’s effective income tax

rate is as follows:

2009 2008 2007

Statutory income tax rate ....................................... 35.0% 35.0% 35.0%

State and local income taxes, net .................................. 0.7 1.0 1.1

Investment of foreign earnings in U.S. . ............................ — 3.5 4.4

Tax on international earnings .................................... (7.5) (7.9) (10.9)

Fair value adjustment of liabilities potentially settleable in common stock . . . — — 3.4

Exam settlements and statute expirations ............................ (0.5) (0.8) (6.5)

Other, net ................................................... 1.5 (0.4) 1.5

29.2% 30.4% 28.0%

During 2009 the Company indefinitely reinvested all current year international net earnings outside the

U.S. In 2008 and 2007, the Company designated $60,000 and $90,000, respectively, of the international net

earnings during those years that will not be indefinitely reinvested outside of the U.S. The incremental income

tax on these amounts, representing the difference between the U.S. federal income tax rate and the income tax

rates in the applicable international jurisdictions, is a component of deferred income tax expense.

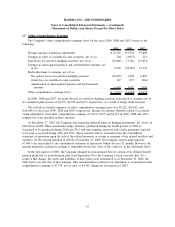

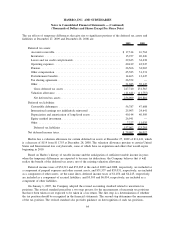

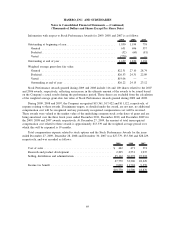

The components of earnings before income taxes, determined by tax jurisdiction, are as follows:

2009 2008 2007

United States ........................................ $248,654 208,125 165,274

International ........................................ 281,043 232,930 297,108

$529,697 441,055 462,382

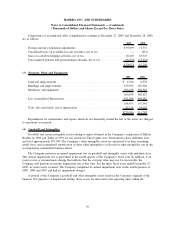

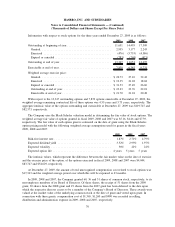

The components of deferred income tax expense arise from various temporary differences and relate to

items included in the statements of operations as well as items recognized in other comprehensive earnings.

63

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)