Hasbro 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.addition, the Company is seeking to grow its business in entertainment and digital gaming, and will continue

to evaluate strategic alliances and acquisitions which may complement its current product offerings, allow it

entry into an area which is adjacent to or complementary to the toy and game business, or allow it to further

develop awareness of its brands and expand the ability of consumers to experience its brands in different

forms of media. In addition to the Discovery joint venture discussed above, another example of this includes

the acquisition of Cranium, Inc., a developer and marketer of CRANIUM branded games and related products,

in 2008. In addition, in the second quarter of 2008, the Company acquired the rights to TRIVIAL PURSUIT, a

brand which the Company had previously licensed on a long-term basis. Ownership of the rights will allow

the Company to further leverage the brand in different media. In 2009, the Company continued to expand its

brand portfolio through several smaller brand acquisitions that it believes will be complementary to its core

brands.

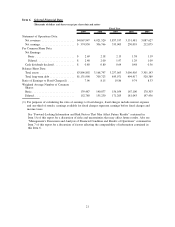

While the Company remains committed to investing in the growth of its business, it also continues to be

focused on reducing fixed costs through efficiencies and on profit improvement. Over the last 7 years the

Company has improved its full year operating margin from 7.8% in 2002 to 14.5% in 2009. The Company

reviews its operations on an ongoing basis and seeks to reduce the cost structure of its underlying business and

promote efficiency.

In recent years, the Company has been seeking to return excess cash to its shareholders through share

repurchases and dividends. As part of this initiative, over the last five years, the Company’s Board of Directors

(the “Board”) has adopted four successive share repurchase authorizations with a cumulative authorized

repurchase amount of $1,700,000. After fully exhausting the prior three authorizations, the fourth authorization

was approved on February 7, 2008 for $500,000. For the years ended 2009, 2008 and 2007, the Company

spent $90,994, $357,589 and $587,004, respectively, to repurchase 3,172, 11,736 and 20,795 shares, respec-

tively, in the open market. Also in 2007, the Company paid $200,000 in cash to repurchase exercisable

warrants for 15,750 shares of the Company’s common stock. The Company intends to, at its discretion,

opportunistically repurchase shares in the future subject to market conditions. At December 27, 2009, the

Company had $161,434 remaining under the February 2008 authorization. In addition, in February 2010 the

Company announced an increase in its quarterly dividend to $0.25 per share.

During 2009, the Company operated in an environment of both a stronger U.S. dollar relative to foreign

currencies compared to 2008 as well as weakened overall economic conditions. Accordingly, the Company has

sought to mitigate the impact of these conditions by instituting a variety of cost control initiatives. As of

December 27, 2009 the Company had $636,045 in cash and cash equivalents and had available capacity, if

needed, under its revolving credit agreement and accounts receivable securitization program. In connection

with the announcement of a joint venture agreement with Discovery in April 2009, the Company made a

$300,000 cash payment to purchase its 50% share of the joint venture. The Company funded its investment

through the issuance of debt with a principal amount of $425,000 in May 2009. The Company believes that

the funds available to it, including cash expected to be generated from operations and funds available through

its available lines of credit, accounts receivable securitization program and other borrowing facilities are

adequate to meet its working capital needs for 2010.

24