Hasbro 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

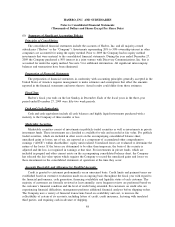

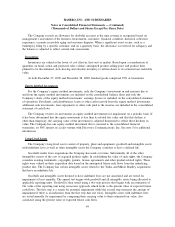

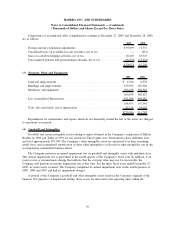

The remaining intangibles having defined lives are being amortized over periods ranging from five to

twenty-five years, primarily using the straight-line method. At December 27, 2009, approximately 14% of

other intangibles relate to rights acquired in connection with a major entertainment property and are being

amortized in proportion to projected sales of the licensed products over the contract life.

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed

using accelerated and straight-line methods to depreciate the cost of property, plant and equipment over their

estimated useful lives. The principal lives, in years, used in determining depreciation rates of various assets

are: land improvements 15 to 19, buildings and improvements 15 to 25 and machinery and equipment 3 to 12.

Depreciation expense is classified in the statement of operations based on the nature of the property and

equipment being depreciated. Tools, dies and molds are depreciated over a three-year period or their useful

lives, whichever is less, using an accelerated method. The Company generally owns all tools, dies and molds

related to its products.

The Company reviews property, plant and equipment and other intangibles with defined lives for

impairment whenever events or changes in circumstances indicate the carrying value may not be recoverable.

Recoverability is measured by a comparison of the carrying amount of an asset or asset group to future

undiscounted cash flows expected to be generated by the asset or asset group. If such assets were considered

to be impaired, the impairment to be recognized would be measured by the amount by which the carrying

value of the assets exceeds their fair value. Fair value is determined based on discounted cash flows or

appraised values, depending on the nature of the assets. Assets to be disposed of are carried at the lower of the

net book value or their estimated fair value less disposal costs.

Financial Instruments

Hasbro’s financial instruments include cash and cash equivalents, accounts receivable, short-term borrow-

ings, accounts payable and accrued liabilities. At December 27, 2009, the carrying cost of these instruments

approximated their fair value. The Company’s financial instruments at December 27, 2009 also include long-

term borrowings (see note 8 for carrying cost and related fair values) as well as certain assets and liabilities

measured at fair value (see notes 8, 11 and 15).

Securitization and Transfer of Financial Instruments

Hasbro has an agreement that allows the Company to sell, on an ongoing basis, an undivided fractional

ownership interest in certain of its trade accounts receivable through a revolving securitization arrangement.

The Company retains servicing responsibilities for, as well as a subordinate interest in, the transferred

receivables. In 2009 and prior, Hasbro accounted for the securitization of trade accounts receivable as a sale in

accordance with then current accounting standards. As a result, the related receivables were removed from the

consolidated balance sheet.

In 2010, the Company adopted the revised accounting standards related to the transfer of financial assets.

As a result of the adoption of these standards, the Company will be required to account for the sale of the

receivables under the securitization facility as a secured borrowing. The receivables sold will continue to be

included in accounts receivable until collection. The proceeds from utilization of the facility will be recorded

as short-term debt.

Revenue Recognition

Revenue from product sales is recognized upon the passing of title to the customer, generally at the time

of shipment. Provisions for discounts, rebates and returns are made when the related revenues are recognized.

50

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)