Hasbro 2009 Annual Report Download - page 42

Download and view the complete annual report

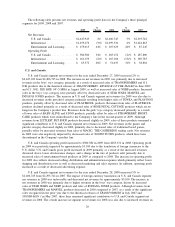

Please find page 42 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.receivable, primarily as a result of the Company’s decision not to utilize its securitization program at

December 27, 2009. At December 28, 2008, $250,000 was utilized under the program. In 2009, operating cash

flows were also impacted by increased royalty payments, including a $50,000 guaranteed royalty payment to

Marvel related to the extension of the current agreement and a $25,000 guaranteed royalty payment to the

Discovery joint venture. Further, the decrease in inventory had a positive impact on 2009 operating cash flows.

In 2007 operating cash flows were impacted by royalty advances paid of $70,000 related to the Marvel license.

In addition, 2007 net earnings included non-cash expense of $44,370 related to the fair value adjustment of the

Lucas warrants that were repurchased in May of 2007. The remaining decrease in 2008 operating cash flows

was due to decreased net earnings in 2008 compared to 2007.

Accounts receivable increased to $1,038,802 at December 27, 2009 from $611,766 at December 28, 2008.

The accounts receivable balance at December 27, 2009 includes an increase of approximately $33,200 as a

result of a weaker U.S. dollar at December 27, 2009 as compared to December 28, 2008. Absent the effect of

foreign exchange, the increase in accounts receivable primarily reflects the utilization of the Company’s

securitization program at December 28, 2008 of $250,000. At December 27, 2009, based on the Company’s

cash position and liquidity needs, there was no utilization of the securitization program. The increase in

accounts receivable also reflects higher sales, and the timing of those sales, in the fourth quarter of 2009 as

compared to 2008. Accounts receivable decreased to $611,766 at December 28, 2008 from $654,789 at

December 30, 2007. The accounts receivable balance at December 28, 2008 includes a decrease of

approximately $61,100 as a result of the stronger U.S. dollar in 2008 as compared to 2007. Absent the impact

of foreign exchange, accounts receivable increased slightly. Fourth quarter days sales outstanding were 68 days

in 2009 and 45 days in both 2008 and 2007. Absent the impact of securitization, days sales outstanding would

have been 63 days in 2008 and 2007.

Inventories decreased to $207,895 at December 27, 2009 compared to $300,463 at December 28, 2008.

The decrease primarily reflects higher inventory levels at December 28, 2008 due to decreased sales in the

fourth quarter of 2008 as well as increased sales in the fourth quarter of 2009. Inventories increased to

$300,463 at December 28, 2008 from $259,081 at December 30, 2007. The increase was primarily related to

lower revenues in the fourth quarter of 2008 as a result of the weak retail environment and, to a lesser extent,

inventory balances related to newly opened operations in emerging markets. The December 28, 2008 inventory

balance includes a decrease of approximately $20,900 as a result of the currency impact of the stronger

U.S. dollar at December 28, 2008 compared to December 30, 2007.

Prepaid expenses and other current assets decreased to $162,290 at December 27, 2009 from $171,387 at

December 28, 2008. The decrease is primarily due to a decrease in the value of the Company’s foreign

currency contracts as a result of the weakening U.S. dollar, partially offset by purchases of short-term

investments of $18,000 in 2009, which are reflected as an investing activity in the accompanying consolidated

statement of cash flows. Prepaid expenses and other current assets decreased to $171,387 at December 28,

2008 from $199,912 at December 30, 2007. This decrease was primarily due to utilization of a portion of the

Marvel and the remainder of the Lucas prepaid royalty advances. Generally, when the Company enters into a

licensing agreement for entertainment-based properties, an advance royalty payment is required at the

inception of the agreement. This payment is then recognized in the consolidated statement of operations as the

related sales are made. At December 28, 2008, the Company had prepaid royalties related to the Marvel

license in both current and non-current assets. Each reporting period, the Company reflects as current prepaid

expense the amount of royalties it expects to reflect in the statement of operations in the upcoming twelve

months. The decrease in prepaid expenses and other current assets in 2008 was partially offset by an increase

in the value of the Company’s foreign currency contracts as a result of the strengthened U.S. dollar at

December 28, 2008.

Accounts payable and accrued expenses increased to $801,775 at December 27, 2009 from $792,306 at

December 28, 2008. The accounts payable and accrued expenses balance at December 27, 2009 includes an

increase of approximately $17,700 as a result of a weaker U.S. dollar at December 27, 2009 as compared to

December 28, 2008. Absent the impact of foreign exchange, accounts payable and accrued expenses decreased

approximately $8,300. Decreases in accounts payable and accrued expenses in 2009 primarily relate to

decreased accrued pension benefits, as well as lower accounts payable. These decreases were partially offset

32